Exchange Traded Funds (ETFs) are a simple way for investors to gain access to a wide range of asset classes. They are open-ended funds whose units trade on a securities exchange (Exchange), just like an ordinary listed security. They enable investors to gain access to a portfolio of securities in one easy transaction – either online or through a stockbroker.

Passive ETFs have existed since 1993 when State Street launched the SPDR S&P 500 ETF in the US. Passive ETFs typically track an index (such as the ASX200 index) and the portfolio is updated regularly (generally quarterly) to reflect changes in the reference index.

Active ETFs, where an investment manager is actively managing a portfolio of securities, have existed globally for some time. However, there have been few choices available to investors as investment managers have been reluctant to publish their portfolios daily. In Australia, Active ETF issuance started to evolve in early 2015 when issuers and regulators agreed on a portfolio disclosure regime that balanced the needs of investors who want to know what they are investing in with the protection of the investment manager’s intellectual property (its portfolio holdings and active portfolio decisions).

What are the similarities?

STRUCTURE

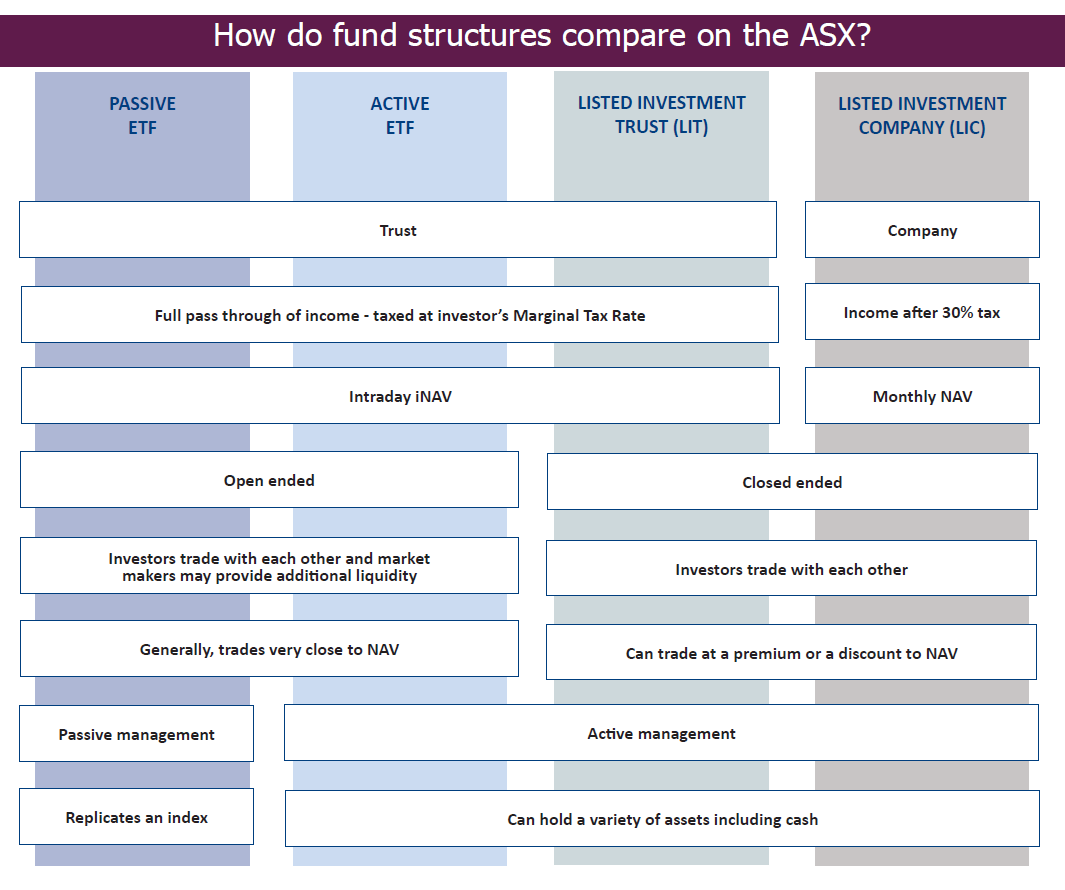

In Australia, both Passive and Active ETFs are generally registered managed investment schemes, a type of ‘unit trust’, that trades on the Exchange in the same way that a share in a company trades on an Exchange. Like any share or unit traded on an Exchange, investors can buy or sell units in the ETF from each other through the Exchange.

TRANSPARENCY

Investors have transparency as to the value of the underlying fund and the composition of its portfolio through regular disclosure provided on the Exchange and the ETF issuer’s website. The value of the ETF’s underlying investments is generally provided in the form of the net asset value (NAV) per unit and an indicative intraday net asset value (iNAV) per unit, which generally updates throughout the ASX trading day. The level of portfolio disclosure will generally depend on whether the ETF is a Passive ETF or an Active ETF and, in the case of the latter, adhering to regulatory guidance on portfolio holding disclosure. Passive ETFs will either provide an iNAV per unit and/or full portfolio disclosure on a daily basis. Active ETFs that employ an internal market making model will generally provide daily net asset value and iNAV per unit, monthly fund updates and a full portfolio comprising names and weights of the investments on a quarterly basis.

LIQUIDITY

In seeking to ensure there is efficient trading in the secondary market of ETF units and with the objective of having the trading price track the underlying NAV, ETF issuers put in place additional liquidity arrangements. As ETFs are open-ended funds and can issue and redeem units, they are able to facilitate these liquidity arrangements.

Passive ETF issuers largely outsource the provision of liquidity to third-party market makers or authorised participants such as institutional brokers. Market makers trade an inventory of units on the Exchange and are able to apply or redeem with the ETF issuer to settle their net trading position. These market makers form their own view of the NAV of the ETF and provide bids and offers in the market around that value, within the bounds of their own balance sheet risk appetite for providing this liquidity.

Active ETF issuers either follow the same market making model as Passive ETFs or opt to be internal market makers where they seek to provide sufficient liquidity for the ETF. This means that the ETF might, at any time, be providing bids and offers in the market around the issuer’s assessed value of the units at that time.

TAXATION

Being unit trusts, both Passive and Active ETFs allow a full passthrough of income on a pro-rata basis such as dividends, franking credits, capital gains and discounted capital gains income and net income is taxed in the hands of the end investor.

What are the differences?

TYPES OF INVESTMENTS

With an Active ETF, a portfolio manager will undertake stock research to determine which underlying securities or stocks to hold and in what percentages. They will then actively manage weightings of the stocks depending on stock valuations, industry trends and views on macroeconomics. They can also hold cash to manage the overall risk of the portfolio and to take advantage of opportunities when markets move.

A Passive ETF tracks an index. This can be over a broad-based stock market index, a sector index, custom-built indices or indices comprising fixed income, credit, commodities and currency. They can either fully replicate an index by buying all the securities that make up the index or they can be optimised by buying the securities in an index that provides the most representative sample of the index based on correlations, exposure and risk.

Passive ETFs can either attempt to track their target indices by holding all, or a representative sample, of the underlying securities that make up the index or instead of physically holding each of the securities they can hold synthetic exposure to securities by using derivatives such as swaps to execute their investment strategy.

How many ETFs are available on the ASX?

As at the end of January 2024, there were 325 Active and Passive ETFs available on the ASX with over $178 billion* in market capitalisation.

How do I access ETFs?

You can access both Passive and Active ETFs on the ASX via your online share trading account or through your stockbroker. You will need to know the ASX code that relates to the ETF.

*Source: ASX Investment Product Monthly Update – January 2024.