Fund Overview

The Airlie Australian Share Fund provides an opportunity to access a highly experienced investment team with a proven track record of prudent, common-sense investing.

The fund will hold a concentrated basket of between 15-35 quality Australian listed companies – Airlie's best ideas. Maximum cash holding of 10% with an aim to be fully invested. The partnership between Airlie and Magellan offers Airlie’s experience in Australian equities with Magellan’s considerable expertise in operating and distributing retail funds for Australian investors.

Investment objective

The Fund’s primary objective is to provide long-term capital growth and regular income through investment in Australian equities.

Fund Facts

Transaction costs may also apply - refer to the Product Disclosure Statement. All management costs described above are inclusive of the estimated net effect of GST.

Click here for further information on the benchmark.

* iNAV calculations as shown on www.airliefundsmanagement.com.au (the "data") provided by ICE Data Indices, see ICE Terms of Use, and is updated during ASX trading hours. Powered by Factset. iNAV is indicative and for reference purposes only. The Fund is not sponsored, endorsed, sold or marketed by ICE Data Indices, LLC, its affiliates ("ICE Data") and ICE Data or its respective third party suppliers MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIM ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE WITH RESPECT TO THE iNAV, IOPV, FUND OR ANY FUND DATA INCLUDED THEREIN. IN NO EVENT SHALL ICE DATA HAVE ANY LIABILITY FOR ANY SPECIAL, PUNITIVE, DIRECT, INDIRECT, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS), EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES. You acknowledge that the data is provided for information only and should not be relied upon for any purpose.

INVESTMENT RISKS: All investments carry risk. While it is not possible to identify every risk relevant to an investment in a fund, we have provided details of risks in the fund's Product Disclosure Statement.

Portfolio Construction

Financial Strength

The first thing we consider is the balance sheet. Only those companies with solid financial characteristics, including appropriate levels of debt for the business model, are considered for investment.

Business Quality

The research process focuses on the quality of the business: looking for businesses that can earn attractive or improving returns on capital in the future.

Given the decades of investment experience of the Airlie team, we typically have considerable knowledge of the histories, industries and strategies of the stocks in which we invest.

Quality of Management

Airlie seeks to invest in companies with competent managers whose interests ideally align with those of shareholders. Airlie has a particular preference for investing in founder-led businesses, which it has found typically exhibit a longer-term focus that is rewarding for shareholders. In order to make an assessment of business and management quality, Airlie regularly meets with management teams and boards of Australian companies.

Valuation

Airlie turns to valuation last, as we believe you can only value a business if you understand it. We see returns as the ultimate driver of valuation, and focus our efforts on understanding the likely direction of future returns. We seek to invest where our assessment of the quality and worth of a business exceeds the prevailing market price.

We also explicitly consider ESG risks as part of our investment process.

Meet the Portfolio Managers

The Airlie Investment Team is one of depth and experience. Portfolio Managers Matt, Emma and Will are supported by a further five investment professionals.

Emma Fisher

Deputy Head of Australian Equities and Portfolio Manager

Emma Fisher has over 13 years investment experience and has been the Portfolio Manager of the Airlie Australian Share Fund since its launch in 2018 and was appointed Deputy Head of Australian Equities in 2023. She joined Airlie in 2016. Prior to this, she was an investment analyst at Fidelity International and Nomura Australia.

Emma holds a Bachelor of Commerce (Liberal Studies) from the University of Sydney.

Matt Williams

Head of Australian Equities

Matt Williams has over 25 years industry experience and joined Airlie Funds Management in 2016 in the role of Portfolio Manager. In 2023 Matt was appointed Head of Australian Equities. Prior to joining Airlie, Matt served as the Head of Equities at Perpetual Investments. Matt joined Perpetual in 1993 and has been a portfolio manager since 1998.

Matt holds a Bachelor of Economics degree from the University of New England.

Performance

| Performance | 3 Months | 6 Months | 1 Year | 3 Years (% p.a.) |

5 Years (% p.a.) |

7 Years (% p.a.) |

Since Inception** (% p.a.) |

|---|---|---|---|---|---|---|---|

| Airlie Australian Share Fund - Active ETF (ASX: AASF) | 8.55% | 4.67% | 10.32% | 13.56% | 12.65% | 9.71% | 10.22% |

| Benchmark* | 9.50% | 6.44% | 13.81% | 13.56% | 11.85% | 8.78% | 9.17% |

| Out/Under Performance | -0.95% | -1.77% | -3.49% | 0.00% | 0.80% | 0.93% | 1.05% |

* S&P/ASX 200 Accumulation Index

Click here for further information on the benchmark.

Important Information: Calculations are based on exit price with distributions reinvested, after ongoing fees and expenses but excluding individual tax, member fees and entry fees (if applicable). Inception date 1 June 2018 (inclusive). Past performance is not a reliable indicator of future performance.

Growth of AUD $10,000

* S&P/ASX 200 Accumulation Index

Click here for further information on the benchmark.

Important Information: Calculations are based on exit price with distributions reinvested, after ongoing fees and expenses but excluding individual tax, member fees and entry fees (if applicable). Inception date 1 June 2018 (inclusive). Past performance is not a reliable indicator of future performance.

Unit Prices

| Date | NAV Per Unit | Entry | Exit |

|---|---|---|---|

| 07-Jul-2025 | 3.9451 | 3.9522 | 3.9380 |

| 04-Jul-2025 | 3.9377 | 3.9448 | 3.9306 |

| 03-Jul-2025 | 3.9359 | 3.9430 | 3.9288 |

| 02-Jul-2025 | 3.9302 | 3.9373 | 3.9231 |

| 01-Jul-2025 | 3.8941 | 3.9011 | 3.8871 |

| 30-Jun-2025 (ex) | 3.9070 | 3.9140 | 3.9000 |

| 30-Jun-2025 | 3.9803 | 3.9875 | 3.9731 |

| 27-Jun-2025 | 3.9512 | 3.9583 | 3.9441 |

| 26-Jun-2025 | 3.9628 | 3.9699 | 3.9557 |

| Download historical unit prices | |||

Distribution history

IMPORTANT

Please ensure that your Tax File Number (TFN) or Australian Business Number (ABN) is provided to the Unit Registry by Record Date, otherwise tax will be withheld on income attributed to you at the top marginal tax rate plus Medicare Levy.

If you have elected to receive distributions in cash, please ensure that your bank account details are provided to the Unit Registry by Record Date, otherwise your distribution payment will be withheld until a valid bank account is provided.

To review or update your TFN/ABN and bank account details, log on to the Unit Registry’s online portal.

| Date | Distribution per unit | Reinvestment price | |

|---|---|---|---|

| June 2025 | 7.33 cents | $3.907 | Annual Fund Distribution 2025 |

| December 2024 | 7.03 cents | $3.8027 | |

| June 2024 | 6.82 cents | $3.6732 | Annual Fund Distribution 2024 |

| December 2023 | 6.85 cents | $3.6824 | |

| June 2023 | 6.68 cents | $3.3896 | Annual Fund Distribution 2023 |

| December 2022 | 6.40 cents | $3.3149 | |

| June 2022 | 6.00 cents | $2.9844 | Annual Fund Distribution 2022 |

| December 2021 | 5.61 cents | $3.6371 | |

| June 2021 | 5.32 cents | $3.3366 | Annual Fund Distribution 2021 |

| December 2020 | 5.21 cents | $2.9141 | |

| June 2020 | 8.00cents | $2.5808 | Annual Fund Distribution 2020 |

| December 2019 | 2.00 cents | $2.8246 | |

| June 2019 | 3.9469 cents | $2.6372 | Annual Fund Distribution 2019 |

| December 2018 | 2.000 cents | $2.3215 | |

| June 2018 | 0.1139 cents | $2.6017 | Annual Fund Distribution 2018 |

Reports and ASX Releases

Fund Updates

Sign up for monthly fund factsheet emails

ASX announcements

Investor Reports

| 30 Jun 2024 Airlie Australian Share Fund Investor Report 2024 | 30 Jun 2023 Airlie Australian Share Fund Investor Report 2023 | 30 Jun 2022 Airlie Australian Share Fund Investor Report 2022 |

Financial Reports

| 31 Dec 2024 Half Year Financial Report 2024/2025 | 30 Jun 2024 Annual Financial Report 2024 | 31 Dec 2023 Half Year Financial Report 2023/2024 |

| 30 Jun 2023 Annual Financial Report 2023 | 31 Dec 2022 Half Year Financial Report 2022/2023 | 30 Jun 2022 Annual Financial Report 2022 |

| 31 Dec 2021 Half Year Financial Report 2021/2022 | 30 Jun 2021 Annual Financial Report 2021 | 31 Dec 2020 Half Year Financial Report 2020/2021 |

| 30 Jun 2020 Annual Financial Report 2020 | 31 Dec 2019 Half Year Financial Report 2019/2020 | 30 Jun 2019 Annual Financial Report 2019 |

| 30 Jun 2018 Annual Financial Report 2018 |

3 ways to access Airlie Australian Share Fund

- Active ETF (ASX: AASF)

Continuous Disclosure

Magellan is pleased to announce that units in the Fund are expected to commence trading on the securities exchange operated by the ASX on 4 June 2020 under the ticker AASF.

If you are an investor in the Fund your holding of units will not change. You may continue to apply for and redeem units in the Fund in the same way that is offered today. There will be no change to the investment objectives of the Fund or to the fees charged to the Fund.

Commencement of trading of the Fund’s Units on the ASX will coincide with the initiation of an issuer sponsored sub-register. From that time you may move your units to your brokerage account and then trade your units on the ASX through your broker.

A replacement PDS has been lodged with the Australian Securities & Investments Commission ("ASIC") and is available here. The replacement PDS contains important information about the Fund and we recommend that you read the PDS carefully.

This notice provides important information for investors in the Airlie Australian Share Fund (Fund). This update should be read together with the Fund's Product Disclosure Statement dated 22 May 2018 (PDS).

Change of Investment Manager Entity

From 1 December 2019, Magellan Asset Management Limited (Magellan) will replace Airlie Funds Management Pty Limited (Airlie) as the investment manager for the Fund. Whilst the corporate entity acting as the investment manager will change from this date, the Fund’s portfolio managers will continue to be Matt Williams and Emma Fisher, who are both employees of Magellan.

Why is this change being made?

Airlie is a wholly-owned subsidiary of Magellan. In order to maximise operational efficiencies, Magellan is being appointed as investment manager of the Fund, replacing Airlie. Magellan will also continue to act as Responsible Entity of the Fund.

What do I need to do?

If you are an existing investor in the Fund, the transition to Magellan as the investment manager of the Fund will not result in any change to your unitholding and there is nothing that you will need to do.

If you are considering an investment in the Fund, please ensure you read this notice together with the Fund’s PDS.

Set out below are the upcoming changes that impact Airlie Australian Share Fund (ARSN – 623 378 487).

1. Change to Payment Options - Additional Investments

-

Removal of Direct Debit

From 1 December 2019, Magellan Asset Management Ltd (“Magellan”) will no longer be offering Direct Debit as a payment option for additional investments to Airlie Australian Share Fund.

BPAY®, Electronic Funds Transfer (“EFT”) and Australian Dollar Cheque will continue as payment methods for additional investments. The minimum amounts for additional investments by these methods will remain unchanged at $500 for BPAY® and $5,000 for EFT and Cheque.

2. Regular Monthly Investment Plan – cancellation

From 20 November 2019, the Regular Monthly Investment Plan (“Plan”) administered by means of Direct Debit will no longer be available. For those investors who currently have a Plan set up, the last Direct Debit from a nominated bank account will occur on this date. The easiest way for investors to either continue to, or start to, add to existing investments on a regular basis would be to set up a recurring BPAY® payment with their financial institution.

Investment Insights

Buy Hold Sell: 5 companies with powerful earnings potential

Airlie's Will Granger and IML's Marc Whittaker analyse 3 stocks with big earnings potential, and each share one they particularly like.

Buy Hold Sell: 5 Aussie companies ahead of the competition (and 2 big buys)

Will Granger explains why quality becomes so significant in market turbulence and shares his current favourite high-quality small and mid-cap stock names.

Buy Hold Sell: Hunting for quality in ASX small and mid-caps, and 4 cracking picks

Airlie Funds Management's Will Granger and Marc Whittaker from IML define "quality" and where to find it in the small and mid-caps space.

FAQs

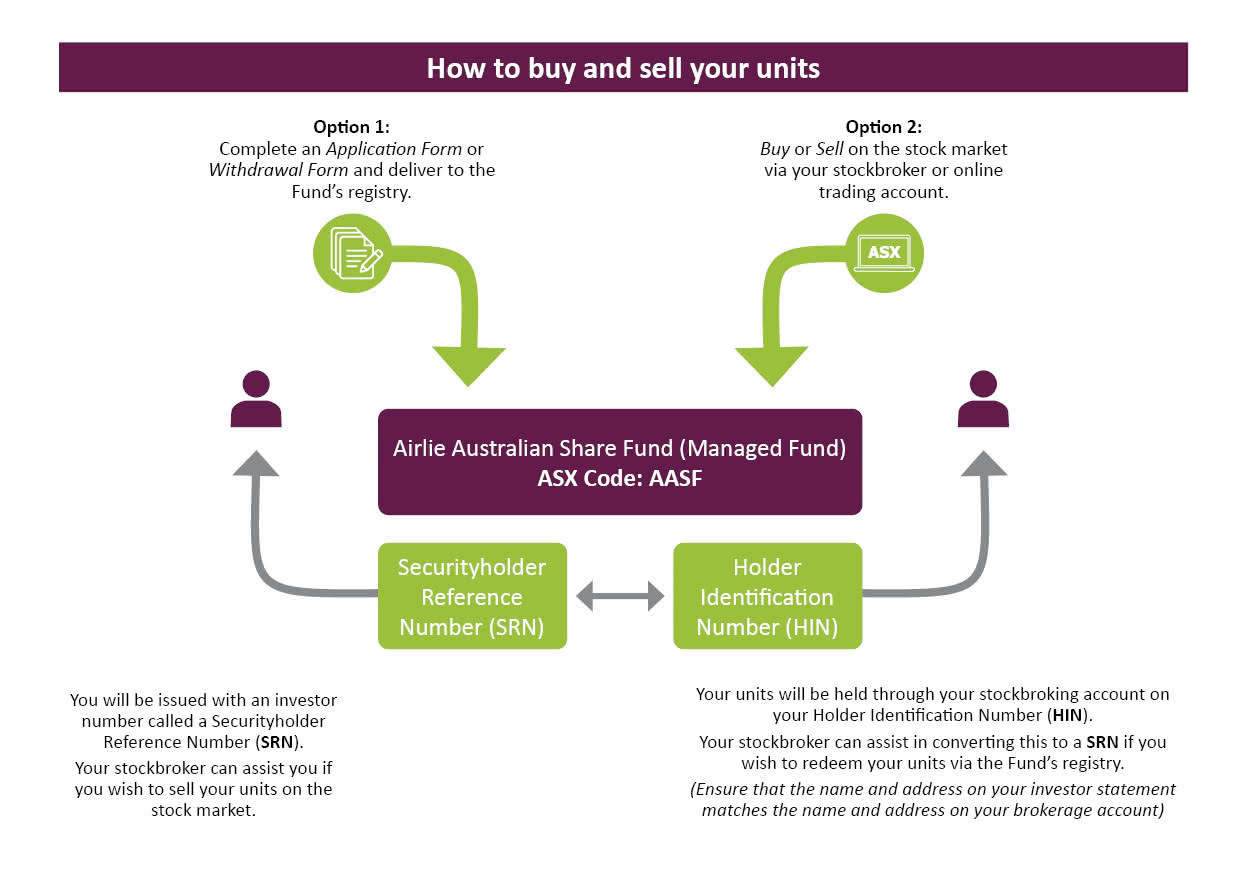

You have the choice of either buying units on the Securities Exchange (Ticker: AASF) via your stockbroker/online broker or applying directly with the Responsible Entity by sending an Application Form to our unit registry.

If you hold your investments via an investment administration platform, you should consult your financial adviser who will be able to assist you in investing in the Fund.

There are important differences between investing in the Fund through the Securities Exchange or by applying directly with the Responsible Entity, including the price you will receive. You should read the PDS before making any decision on how to invest in the Fund.

You can exit the Fund either by making a withdrawal request to the Responsible Entity using a Withdrawal Form or by selling units on the Securities Exchange (Ticker: AASF) via your stockbroker or online broker. How you enter the Fund does not affect the method by which you can exit the Fund.

| To make a withdrawal request with the Responsible Entity…. | |

| If you have a Securityholder Reference Number (SRN) or Investor Number | You will need to provide your SRN or Investor Number on your Withdrawal Form |

| If you have a Holder Identification Number (HIN) with your stockbroker or online broker | You will need to convert your holding from your HIN with your stockbroker or online broker to an SRN issued by the unit registry. This is a standard process which your stockbroker or online broker can assist you with. |

| To sell your units on the Securities Exchange…. | |

| If you have a Securityholder Reference Number (SRN) or Investor Number | You can provide your SRN to certain stockbrokers who can sell your units on your behalf. If your stockbroker does not offer this service, you will need to ask your stockbroker to convert or transfer your holding onto a HIN. This is a standard process which your stockbroker can assist you with. You can then instruct your stockbroker to sell your units on the Securities Exchange. |

| If you have a Holder Identification Number (HIN) with your stockbroker | You can instruct your stockbroker to sell your units on the Securities Exchange. |

There are important differences between exiting the Fund via the Securities Exchange or by withdrawing directly with the Responsible Entity, including the price you will receive. You should read the PDS or consult with your financial adviser before making any decision on how to invest in the Fund.

Your HIN or SRN can be found on the top right hand corner of your holding statement and other shareholder communications. You will typically have a HIN if you bought your units on the Securities Exchange through a stockbroker. You will typically have an SRN if you applied for unit directly with the Responsible Entity.

A HIN is a Holder Identification Number issued by your stockbroker. It is a unique number used to link all your holdings, stocks, shares, and not specific to just Magellan. A HIN is 11 characters long. It starts with an ‘X’ followed by 10 digits. For example: X0001235898

An SRN is a Securityholder Reference Number issued by the Fund’s Unit Registry and is your unique identifier in the Fund. An SRN is 11 characters long and starts with an ‘I’ followed by 10 digits. Example: I00874500369. Your SRN will be stated on your first confirmation statement and partly masked for subsequent statements.

If you invest on the Securities Exchange there is no initial minimum investment amount.

If you invest directly with the Responsible Entity by sending us an Application Form, the minimum initial investment is A$10,000 which is the same as all Magellan’s unlisted funds.

Additional investments can be made into an existing account at any time. No minimum applies for additional investments by BPAY. A minimum of $5,000 applies to other payment methods.

Yes, you may choose to automatically reinvest your distribution as additional units in the Fund regardless of how you acquired your units. If you wish to participate in the Distribution Reinvestment Plan (DRP), you can either update your election in the Unit Registry portal, available at magellan.mainstreamfs.com/login or complete the DRP Election Form located here.

The Fund charges a management and administration fee of 0.78% per annum.

Transaction costs may also apply - refer to the Product Disclosure Statement. All management costs described above are inclusive of the estimated net effect of GST.

The Responsible Entity intends that the Fund will make distributions on a half yearly basis. The Fund may make distributions more or less frequently at the discretion of the Responsible Entity but will generally make a distribution to investors at least annually.

The Fund is an active stock portfolio that will generally comprise 15 to 35 securities at any one time. The Fund references the S&P/ASX 200 Accumulation Index for comparative performance measurement.

The Fund aims to have a cash or cash equivalents range of 0-10%, but generally intends to be fully invested.

The Fund is an active, typically 25 stock, portfolio with a maximum limit of issued capital ownership of 15%. The Fund can hold a maximum of 15% of any one stock in the portfolio.

The Fund has been rated by Zenith (as at June 2024), Morningstar (as at August 2023) and Lonsec (as at September 2023). Please visit the individual research house's website to view the rating and full report.

Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management (‘Airlie’). This material has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product may be obtained by calling by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au. Past performance is not necessarily indicative of future results and no person guarantees the future performance of any fund, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Airlie will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material. Further information regarding any benchmark referred to herein can be found at www.airliefundsmanagement.com.au. Any third party trademarks contained herein are used for information purposes only and are the property of their respective owners. Airlie claims no ownership in, nor any affiliation with, such trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie.

1Research house ratings disclaimers

The Zenith Investment Partners (“Zenith”) Australian Financial Services License No. 226872 rating (assigned 26 June 2025) referred to in this document is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at https://www.zenithpartners.com.au/our-solutions/investment-research/

The rating published on 10/2024 for Airlie Australian Share Fund is issued by Lonsec Research Pty Ltd ABN 11 151 658 561 AFSL 421 445 (Lonsec Research). Ratings are general advice only and have been prepared without taking account of investors’ objectives, financial situation or needs. Consider your personal circumstances, read the product disclosure statement and seek independent financial advice before investing. The rating is not a recommendation to purchase, sell or hold any product. Past performance information is not indicative of future performance. Ratings are subject to change without notice and Lonsec Research assumes no obligation to update. Lonsec Research uses objective criteria and receives a fee from the Fund Manager. Visit lonsec.com.au for ratings information and to access the full report. © 2024 Lonsec. All rights reserved.

The Genium rating (assigned October 2024) presented in this document is issued by Genium Investment Partners Pty Ltd ABN 13 165 099 785, which is a Corporate Authorised Representative of Genium Advisory Services Pty Ltd ABN 94 304 403 582, AFSL 246580. The Rating is limited to “General Advice” (s766B Corporations Act 2001 (Cth)) and has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without notice. Past performance information is for illustrative purposes only and is not indicative of future performance. It is not a recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision in relation to this financial product(s). Genium receives a fee from the Fund Manager for researching and rating the product(s). Visit Geniumip.com.au for information regarding Genium’s Ratings methodology.