Aspen Group (APZ.ASX) is a small-cap real estate platform focused on two of the country’s biggest long-term trends – the housing affordability crisis and our ageing population.

The business operates across two segments:

• Development where it earns ~30% margins by building and selling affordable homes.

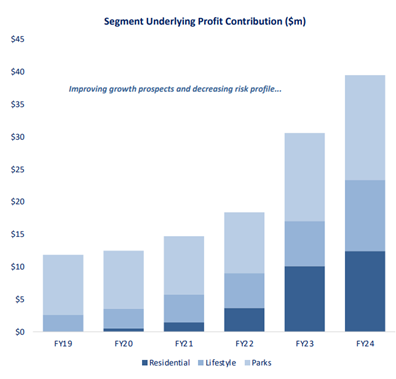

• Operating, which generates recurring rental income from residential, lifestyle (land lease) and park assets.

In response to growing demand and favourable economics, Aspen has deliberately shifted its focus towards lifestyle communities that now contribute a rising share of group profits. The model is simple: Aspen sells dwellings to older Australians and retains land ownership, earning stable rental income on the land funded in most cases by government support.

We see Aspen as a scalable, capital-efficient platform still in the early stages of a long growth runway, led by highly experienced, shareholder-aligned management in David Dixon and John Carter, who together hold almost 10% of the company. We initiated a position at ~$2.50 earlier this year, viewing Aspen as a rare multi-year opportunity to back a business compounding at ~20% CAGR in NAV and underlying EPS – performance we believe remains underappreciated by the market.

HOW THE LAND LEASE MODEL WORKS

The land lease model is a distinctive form of home ownership that separates ownership of the dwelling from the land beneath it. A typical structure looks as follows:

• Land & civils: Aspen acquires land at approximately $40k per site, with civil works (roads, utilities, amenities) costing a further $60k, bringing the total land development cost to ~$100k per dwelling.

• House construction & sale: Aspen then builds each home for around $280k and sells it to the end resident for ~$400k, generating a $120k profit or a ~30% margin.

Source: Aspen Group

From Aspen’s perspective, it:

• Earns a $120k profit from the home sale.

• Retains ownership of the land, which it leases to the home buyer for ~$180 per week. After costs, this delivers ~$120 per week in net rental income, or ~$6,200 annually, equating to a ~6% yield on the $100k land value.

This model is particularly attractive for older Australians, offering affordable home ownership without the upfront burden of land or stamp duty. Residents typically use Commonwealth Rent Assistance to cover the weekly lease payments, making it a low-friction, government-supported

housing solution.

From Aspen’s standpoint, the economics are compelling; it recycles capital efficiently, uses development profits to fund its land bank and creates long-duration, annuity-style income streams on assets it continues to own.

PROVIDING SOLUTIONS FOR AUSTRALIA’S HOUSING CRISIS

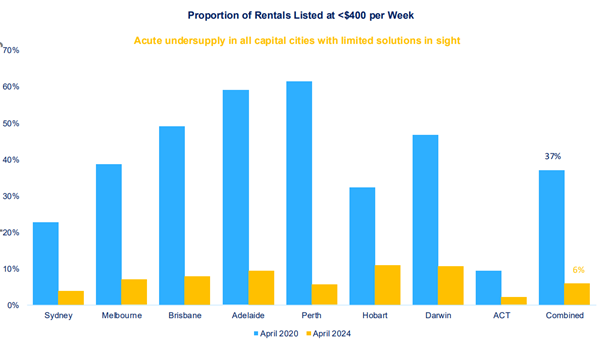

Australia is experiencing significant housing pressure. Rental vacancy rates remain extremely low and advertised rents have increased sharply in recent years. At the same time, the gap between the lower end of private rentals and government-supported housing has widened, making it even harder for low-income Australians to find affordable places to live.

In 2024, just 6% of rental listings across the country were priced under $400 per week – down from 37% in 2020. By contrast, Aspen’s typical land lease product rents for under $200 per week and sells at a ~30% discount to comparable local homes.

Aspen specifically targets the bottom 40% of income earners – those most affected by the affordability crisis. Its model is not only economically sound, but also well-aligned with government policy efforts to address the chronic undersupply of low-cost housing – a challenge that’s expected to persist well into the future.

Source: PropTrack

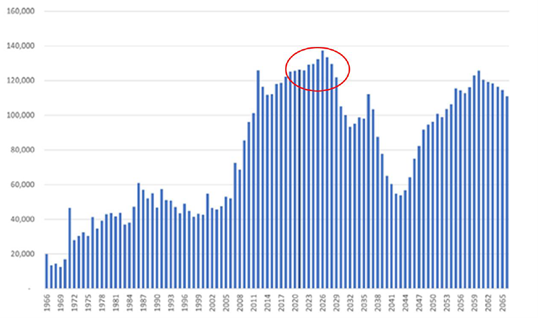

The population aged over 65 is projected to grow at 2.7% per annum for the remainder of the decade, with the proportion of Australians aged 65 and over expected to rise from 16.8% today to 19% by 2030. With more Australians entering retirement each year, the demand for affordable, low-maintenance housing will continue to grow.

Source: AFSA

CONCLUSION

We believe Aspen is led by a standout management team in Joint CEOs David Dixon and John Carter, who bring decades of experience in real estate and investment banking. With their combined ownership stake of almost 10%, they are strongly aligned with shareholders and have a long history of disciplined execution.

Over the past five years, Aspen has delivered ~20% compound annual growth in earnings per share. FY24 underlying EPS rose by 15%, and guidance for FY25 points to another 21% lift. The company now has a current approved pipeline of 1,100 sites, which it aims to double, and is targeting 140 settlements in FY26 and 170 in FY27.

We believe Aspen is still in the early stages of its growth journey. It trades on 20x FY26 earnings and we forecast mid-teens earnings growth over the medium term. With a scalable model, strong tailwinds, and aligned leadership, Aspen represents a compelling long-term opportunity for investors.

In May, we joined Aspen’s management team on a tour of their key Western Australian communities.

SIERRA LIFESTYLE COMMUNITY

Sierra is a rural lifestyle community 60 km northeast of Perth, acquired by Aspen in 2023 for $4 million ($20k per approved dwelling). Formerly the El Caballo Blanco resort, the site was in disrepair with stalled development. Aspen has since revitalised it, selling 12 homes to date (avg. price $344k) and repositioning it as an affordable over-50s community.

Source: Aspen Group

AUSTRALIND

Australind is a flagship 18ha site acquired by Aspen in 2025 for $32.25m (~$80k per dwelling), a steep discount to the ~$100m spent on the site by the previous owner. Located near Bunbury, the site has approvals in place for ~450 lots and includes 97 transportable homes, a 5,000 sqm clubhouse, and extensive landscaping. An additional 10 hectares of adjoining land have completed earthworks and partial civils, providing a significant runway for future development.

Source: Airlie Funds Management

MEADOWBROOKE

Meadowbrooke is a rural lifestyle community near Bunbury, acquired by Aspen in 2021 for $3.26m (~$18k per approved dwelling) out of receivership. The site came with completed civils, and Aspen has since sold 16 homes (avg. price $380k). With 158 undeveloped sites remaining, it offers a strong medium-term growth pipeline on low-cost land.

Source: Aspen Group

By Jack McNally, Senior Equities Analyst