While we have all seen (and probably experienced) the stories of grocery stockpiling during the covid-19 health crisis, we believe these are likely to be short-term benefits for the supermarkets. Current sales spikes aside, we see Coles as an attractive medium-term investment opportunity. Coles is one of the largest food and liquor retailers in Australia and recently began a new chapter in its long history, as a stand-alone listed company following its demerger from the Wesfarmers conglomerate. We think the prospects for Coles are attractive as it continues the operational turnaround that began under Wesfarmers, and the industry emerges from a difficult decade characterised by new entrants, strong competition and price discounting.

Industry emerging from a tough decade

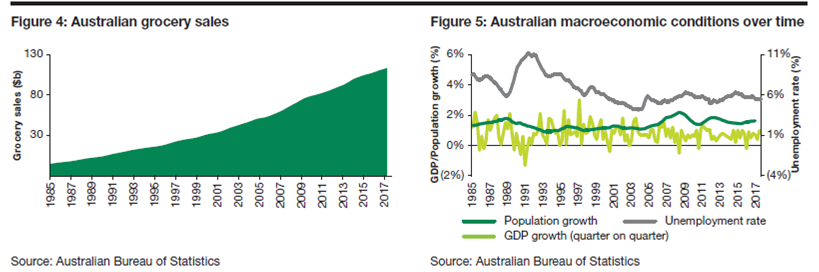

The Australian food and liquor industry has been an attractive one over the past 30 years. Over that time frame, industry revenues have grown at a compound annual growth rate of over 6%, well in excess of GDP, supported by robust population growth and as supermarkets became entrenched in the retail landscape at the expense of traditional butchers, bakers, fresh food retailers and other small grocers.

Over the past 10 years, however, the industry has faced an increase in competition as new entrants such as Aldi and Costco entered the market and forced the incumbents to lower prices to remain competitive. This has reduced revenue growth rates by around half to between 2% to 3% per annum.

However, as new players such as Aldi mature with their store rollouts largely complete, and potential new entrants such as Kaufland decide against entering the Australian market, we are attracted to the prospects for the industry. As competitive intensity moderates, we expect the growth rates for the incumbent players to improve, underpinned by ongoing population growth and the return of modest levels of price inflation.

The Coles opportunity

Coles, after performing poorly for many years, was acquired by Wesfarmers in 2007 and embarked on a major turnaround. Under Wesfarmers ownership, the operating profit of Coles doubled to around A$1.4 billion per annum. This was an impressive sales-driven improvement lead by the ubiquitous ‘Down, Down, Prices are Down’ campaign. While sales and customer numbers into Coles stores have materially improved, there is still work to be done within the Coles business in terms of cost and supply-chain efficiency, and this is an opportunity we are attracted to.

The other key attribute we are attracted to is Coles’s strong financial position, particularly its ability to generate strong cash flows, with an operating cash conversion rate of over 100%. How Coles deploys this cash flow will be critical to the success of the business over the medium term. We see a strong pipeline of investment opportunities focused on improving its supply-chain efficiency and cost position, including A$950 million over six years into two automated distribution centres, a new partnership with global online fulfilment specialist Ocado, and a target to reduce costs by about A$1 billion by fiscal 2023. We expect Coles to generate healthy returns on these investments that on our analysis should help deliver an improved operating profit margin over the next three to five years.

Importantly, given Coles demerged from Wesfarmers with modest levels of debt, combined with its strong operating cash generation, the company will have the financial firepower to make these large investments while still being able to sustainably pay an attractive dividend to shareholders.

Coles or Woolworths?

We often get asked by investors attracted to the Australian food and liquor retail industry whether they should invest in Coles or Woolworths. While Woolworths is a high-quality business run by a capable management team, our current preference from an investment perspective is Coles. First, we believe Coles has an attractive pipeline of opportunities to reinvest in its business as outlined above. We expect Coles to be able to generate good returns on this investment, particularly given a better industry backdrop in which to undertake this investment. Second, we see market expectations, as reflected in the valuation differential between the two stocks, as quite modest around Coles’s ability to retain the benefits of this investment and improve operating margins. Thus the stock has the potential to outperform if the company can exceed these modest expectations.

More than a short-term play on stockpiling

We believe the prospects for Coles over the next three to five years are positive. Importantly, for us, the company remains in a strong financial position with low levels of debt and strong cash generation, enabling it to invest in its business and pay an attractive dividend. The ability to make attractive investments within its existing business to improve profitability – set against an improving industry backdrop – and trading at a relatively attractive valuation have led us to invest in Coles.