When it comes to the consumer discretionary sector, there are some businesses that are less discretionary than others. These businesses tend to be incredibly valuable as their earnings are predictable, less susceptible to managerial error and are more generally insulated from changes in consumer trends. We think Collins Foods is one of these businesses.

Collins Foods is the largest operator of KFC franchises in Australia with 242 restaurants spread mainly across Queensland and Western Australia. The company opened its first KFC restaurant in Queensland in 1969 and Australian consumers have flocked to its restaurants for fried chicken ever since. Indeed, even the pandemic was unable to dent consumer demand for KFC’s products. In the 5 weeks of trading to 3 May 2020, Collins Foods reported a 4% increase in same store sales for its restaurants (excluding food courts). By June, Collins Foods reported a remarkable 11.6% increase in same store sales for the first 7 weeks of trading from 30 April 2020 with customer demand for drive thru and home delivery more than offsetting the negative impact from government restrictions on dine-in.

It is this incredibly loyal customer base and repeat purchasing behaviour which attracted us to Collins Foods.

Franchisees pay a royalty in exchange for a moat

As a franchisee, Collins Foods is responsible for the fit-out, remodelling and day to day operation of restaurants and must also pay a royalty to Yum! Brands (the owner of the KFC brand) for use of its intellectual property. Given that franchisees are responsible for both the operating and capital costs of restaurants, they have a lower return on invested capital and therefore trade on lower multiples than franchisors.

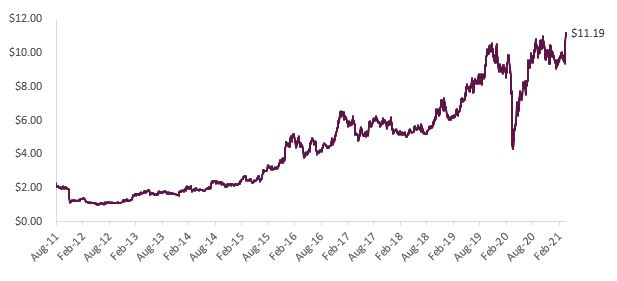

This does not necessarily make them poor investments. Since listing in 2011 Collins Foods’ share price has increased more than fourfold and the company has paid a dividend every year over the past decade.

Figure 1 – Long term share price performance

Source: Factset

We think one reason for its success, is that Collins Foods has effectively purchased its own moat. In paying away some margin in the form of a royalty, Collins is able to market its restaurants under the powerful KFC brand and leverage almost a hundred years’ worth of product development and IP (namely the 11 secret herbs and spices!). When you consider that other businesses spend 10% of sales or more on R&D to protect their moat, we think a 6% royalty to Yum! Brands is a fair trade off. The KFC brand attracts a global customer base and has developed a product that is difficult to compete with in terms of flavour, value, and accessibility. Indeed, there are not too many restaurants we can think of that have operated successfully and are still expanding after 50 years in operation.

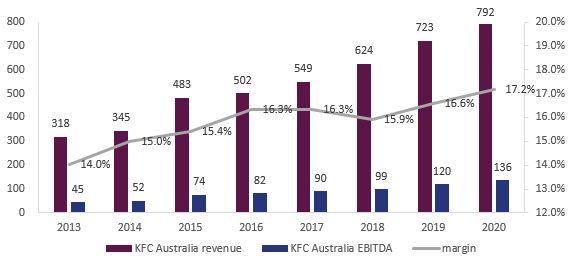

Figure 2 – KFC Australia Long Term Sales and EBITDA

Source: Collins Foods company filings

Long runway for reinvestment

Another reason for Collins Foods’ success is its long runway for reinvestment. Since listing in 2011, Collins Foods has added 125 stores to its KFC network in Australia with each store generating a positive return on its invested capital. While this return on capital might be lower than a franchisor, the duration of the reinvestment period is incredibly powerful.

The company is on track to open 10 new restaurants this year and we think there is scope for Collins Foods to reach 300 KFC restaurants over the coming decade (a 20% increase in its existing store base). Add to this 2 to 3% same store sales growth and you are looking at a business which can grow revenue at 5-6% p.a. over the next decade.

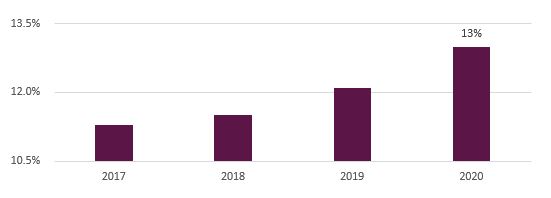

While there is clearly risk in operating a restaurant business, we think the quality of the KFC franchise takes away most of this risk. There is no direct competitor of scale to KFC in the fried chicken category in Australia as demonstrated by its growing market share over the last few years (see Figure 3).

Figure 3 – KFC market share in foodservice chains

Source: Euromonitor, BofA Global Research

Delivery tailwinds

These market share gains should continue as KFC indexes to the fast-growing food delivery market. KFC’s core fried chicken offering is highly conducive to delivery as the chicken is served on the bone which retains heat. As a quick service chain, KFC restaurants are designed to flex during peak hours and delivery is a powerful took to drive incremental sales to its stores and operating leverage. While delivery aggregators do take a margin of sales, Collins Foods is able to recoup this by pricing its products higher on these platforms and also leverages its brand and scale to negotiate better take rates than the average restaurant or café. If you consider that Pizza comprises 80% of the food delivery category, there is still considerable space for KFC’s delivery sales to grow.

European expansion

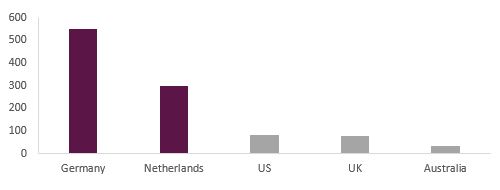

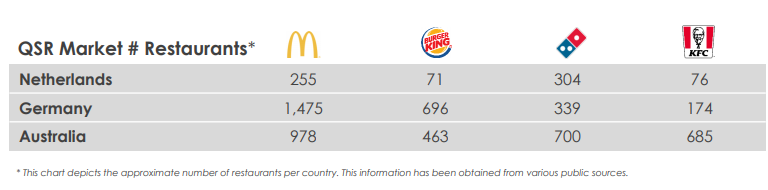

While KFC Australia accounts for over 90% of Collins Foods profit, a potential growth driver for the business is KFC Europe. Collins Foods is the largest KFC franchisee in the Netherlands operating 24 restaurants in that market and also owns 17 KFC franchises in Germany. The KFC brand remains significantly underpenetrated in Europe relative to other global quick service restaurant chains. In Germany for example, there are 10 times the number of McDonalds as there are KFCs (see Figure 4). KFC restaurant density per population is also light in Europe relative to other developed countries (see Figure 5). Assuming Collins Foods can get the model right in Europe, this is potentially huge growth opportunity which is not fully reflected in the share price today.

Figure 4 – Number of restaurants for major QSR chains

Source: Company presentations

Figure 5 – Restaurant density (Population (000s) / KFC restaurant)

Source: Collins Foods company filings

Valuation

Collins Foods is currently trading at a price to earnings multiple of 21x. We feel this valuation is undemanding for a defensive asset with a long runway for store expansion both here and abroad over the coming decade. In a sector which is typically characterised by high levels of competition and is subject to changing consumer preferences, we think Collins Foods stands out as a unique investment opportunity.

By Vinay Ranjan, Airlie Funds Management