A healthcare company that's shrinking to greatness.

January 2021

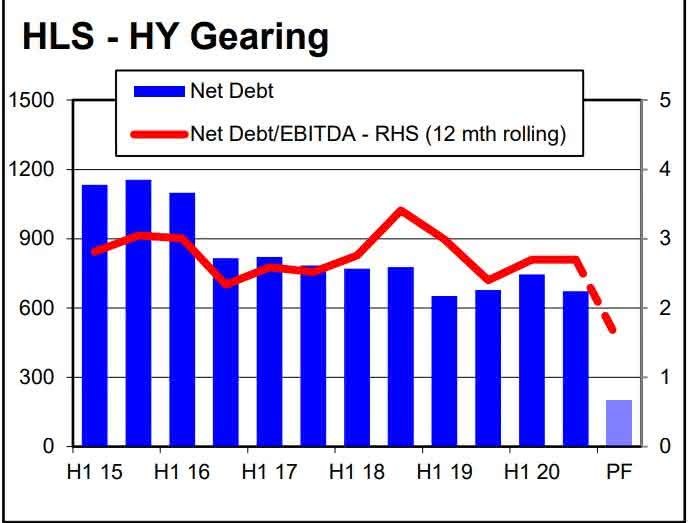

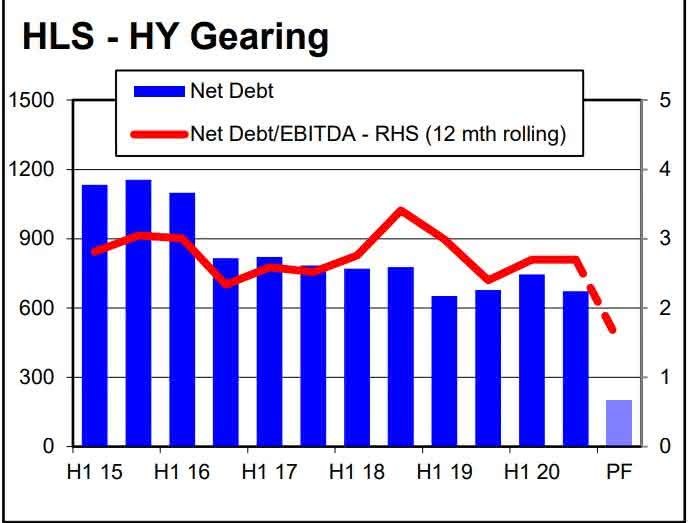

We are always fans of investing in asset rationalisation plays, where businesses are ‘shrinking to greatness’. Healius is one such stock in the portfolio. The business formerly known as Primary Health Care, until recently owned medical centres (where GPs are found). This division was a real problem child - soaking up capex and delivering consistently poor returns. In 2020 Healius management bit the bullet and sold the medical centre business to private equity for circa A$500 million. As non-shareholders in Healius at this time, this move automatically garnered our attention. We felt that previously Healius’ net debt to EBITDA of more than 4-times was too high for the capital intensity of the business. As the chart below shows, Healius went from over-geared to a company that now has capital management ‘options’.

Source: Diogenes Research.

Rejigging the business towards pathology

Now that Healius has sold its poorly performing medical centre business, it is left with three businesses:

(1) Pathology (about 75% of group EBIT);

(2) Imaging (about 25% group EBIT); and

(3) Day Hospitals (currently loss-making).

The core driver of future earnings is the pathology division. The Healius pathology business has had basically flat earnings for five years. This is despite very steady 3% to 5% p.a. revenue growth.

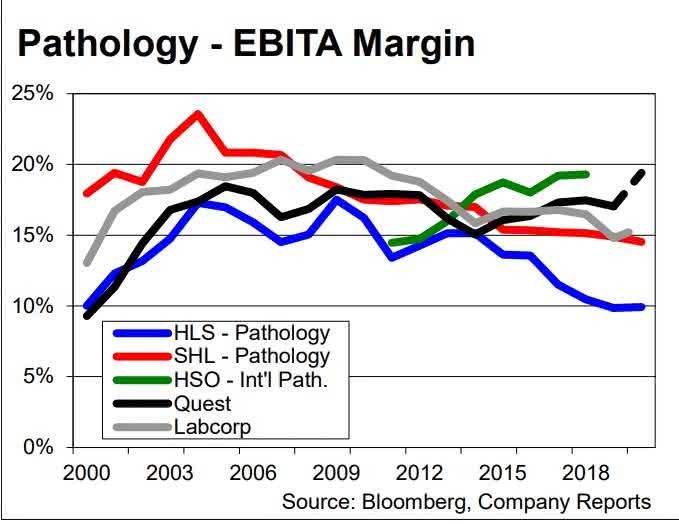

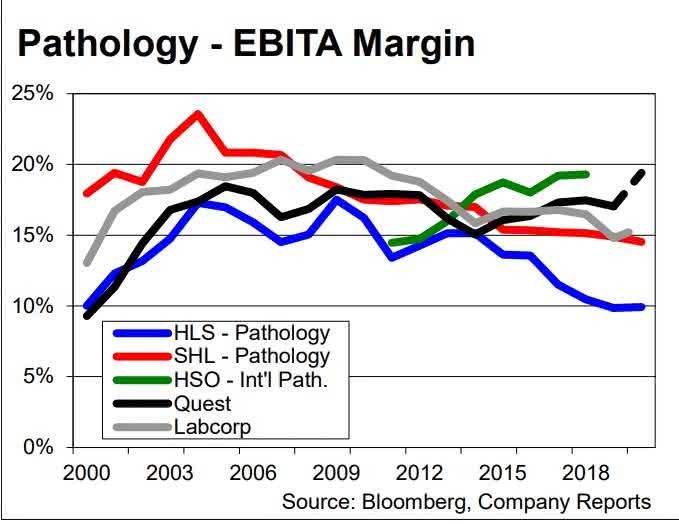

Pathology has had a margin issue

This has been an industry-wide phenomenon, but the worst for Healius. (Note: Sonic’s pathology margin is misleading as it includes international businesses that account for 75% of earnings.)

Source: Diogenes Research

The driver of margin pressure has been an arms race to open new collection centres. Healius and Sonic have spent the past five years rolling out collection centres very aggressively to lock in referral volumes, often paying GPs huge rents to have a pathology collection centre opened in their offices.

This dynamic is now changing. Healius has a new, more rational, management team. The company is closing centres. So far, about 170 centres have closed and management has identified another 200 in total that could close. This would bring Healius’s centre numbers back in line with peer Sonic (which generates A$1.5 billion in revenue versus Healius’s $1.1 billion, hence it makes no sense for Healius to have a higher centre footprint).

.jpg)

Source: Medicare, Company data, Credit Suisse estimates.

At its mid-December investor day, management outlined cost initiatives to drive around 300 basis points of EBIT margin improvement in this division. While execution risks remain, we think the risk versus the reward looks attractive.

We believe Healius can grow pathology earnings at 7% p.a. from here, and this isn’t a heroic assumption given that industry revenue has historically grown at 5.8% p.a. plus margin improvements. If this occurs, lower corporate and interest costs following the medical centre sale would see group EBIT nearly double over the next four years.

By Airlie Funds Management

Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 trading as Airlie Funds Management (‘Airlie’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to an Airlie financial product or service may be obtained by calling +61 2 9235 4760 or by visiting www.airliefundsmanagement.com.au.

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie or the third party responsible for making those statements (as relevant). Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Airlie will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Any third-party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third-party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie.

.jpg)