Good opportunities come in all shapes and sizes. One of the advantages of running a nascent fund (Airlie Small Companies Fund ‘Fund’) is that our relatively small capital base affords us a wide opportunity set, allowing us to invest in the micro-cap end of the market where larger peers cannot deploy meaningful capital. Due to their small size, these companies often fly under the radar of market participants, which can create the opportunity for severely mispriced assets.

One of the Fund’s strongest performers so far has been one of these micro-caps: Joyce Corporation, a $155m retailer that we have held since inception. Joyce own two retail assets: the bedding franchise Bedshed and a 51% stake in KWB, which operates the Kitchen Connection kitchen renovation business. KWB is the jewel in the crown and accounts for the majority of the company’s intrinsic value.

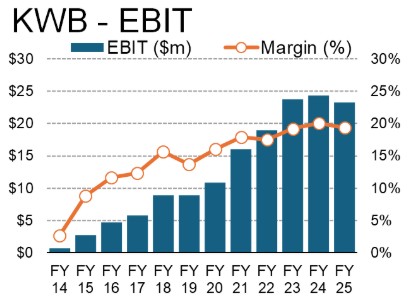

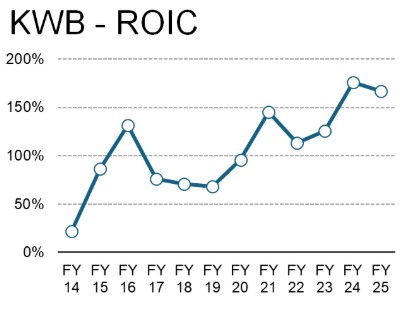

KWB is a leading player in the ‘Do-It-For-Me’ segment of the kitchen renovation market, with 30 showrooms across Australia, primarily located in high foot-traffic homemaker centres. The business is run by Managing Director John Bourke, who acquired KWB back in 2012 with his business partner and retains a 25% ownership stake. John has overseen a stellar track record at KWB, growing earnings before interest and tax (EBIT) at a 24% compound annual growth rate over the past decade while averaging a return on invested capital greater than 100%.

Source: Company financials, Airlie Funds Management

KWB has benefited enormously from John’s meticulous management. While on face value kitchen renovation may not seem like a complex business, projects involve numerous execution risks that can undermine both the customer experience and profitability. One useful indicator is the company’s rework rate – the cost of remedial work (such as replacing damaged cabinetry) expressed as a percentage of sales. When John acquired KWB back in 2012, the rework rate was approximately 5% of sales, a material drag on profitability. As the saying goes, retail is in the detail, and John has implemented a series of changes to improve the scalability and robustness of the model. From decentralising the distribution network through to introducing secondary inspections by qualified cabinet makers, these initiatives have materially reduced that rework rate, which now sits at just 1.2% of sales. This reflects a vast improvement in both profitability and consistency of delivery. Few competitors have been able to replicate this model – there is only one direct, pure-play competitor of decent scale, and historically they have struggled to generate consistent profitability despite KWB’s strong performance.

The fly in the ointment, however, is that John is retiring as MD later this year, passing on the reins to his hand-picked successor, Cameron Crowell. While this transition undoubtedly adds risk, John retains his stake in the business, and is thus heavily incentivised to ensure the business continues executing.

KWB is poised for a strong FY26, with written sales orders increasing 19% in the first four months of the year, supported by strong showroom growth. We estimate KWB can generate $30m of EBIT in FY26. If we apply just a 12x EBIT multiple to this earnings stream, Joyce’s 51% stake would be worth around $180m, or a 30% premium to the current enterprise value. We would argue 12x EBIT is a conservative multiple for KWB given the strong rollout opportunity ahead of the business: management estimates KWB can grow to 50 showrooms just by entering prime homemaker centres across Australia, roughly 70% upside from the current footprint. Combining this large rollout opportunity with the capital-light nature of the business is a recipe for long-term compounding, and the reason Joyce Corporation is a top 5 holding in the Fund.

By Will Granger, Portfolio Manager