July 2020

Over the past decade, Macquarie Group has transformed itself from an investment bank to a world-class asset manager, specialising in infrastructure and renewable energy. It is also one of the few Australian companies to have a long history of success abroad.

Today about two-thirds of Macquarie’s earnings is generated from its annuity-style businesses (funds management and banking and wealth products) that produce recurring revenue year in, year out. The other third of the group’s earnings is generated from market-facing activities (investment banking, etc.) and hence are more volatile. The annuity-style businesses contributed less than 30% to group earnings 10 years ago. This transformation to a more predictable earnings stream is why we think the quality of Macquarie’s earnings is much higher today than a decade ago. Higher-quality earnings equal higher valuation multiples.

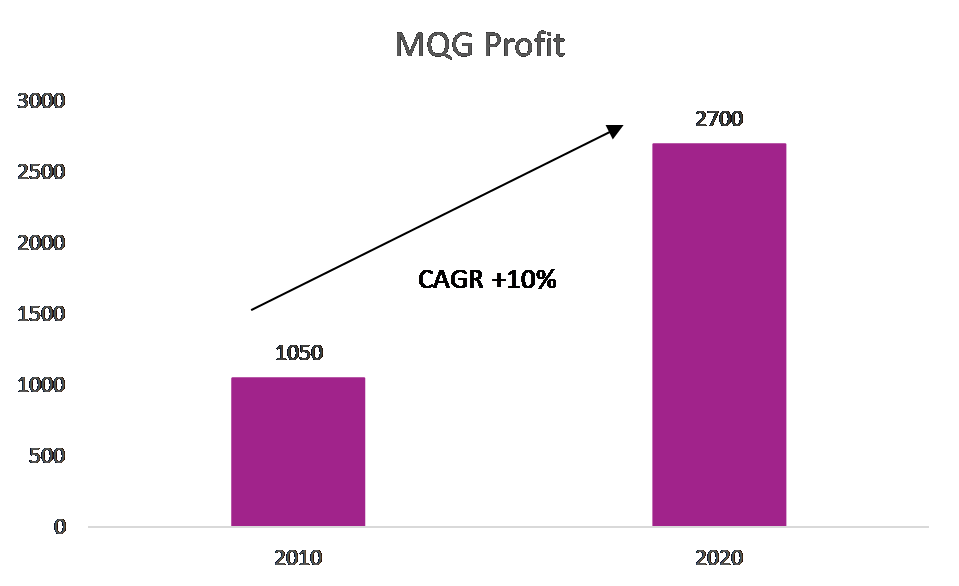

We are attracted to Macquarie’s superior capital allocation and its proven ability to adapt and shift its business mix according to market conditions. This is not an easy achievement and reflects the unique culture and operating system that has developed over the past 30 years. The result? Higher returns and higher earnings growth versus its financial sector peers – Macquarie delivered an average of 10% earnings growth over the past ten years (see chart 1), a superior return on equity, without excessive leverage. The scars of the global financial crisis, where Macquarie’s more fragile business mix and reliance on short-term funding were exposed, have led to a much stronger business and firmer capital and funding underpinnings.

Chart 1. Macquarie's impressive profit growth since 2010

Source: Airlie Funds Management

Structural growth story

Macquarie’s main annuity-style business is asset management, which makes up about 40% of group earnings. The asset-management business is leveraged to two strong structural growth stories; namely, demand for infrastructure and renewable energy. Macquarie was early to both sectors and over the past 30 years has developed deep expertise and capability, becoming a world leader.

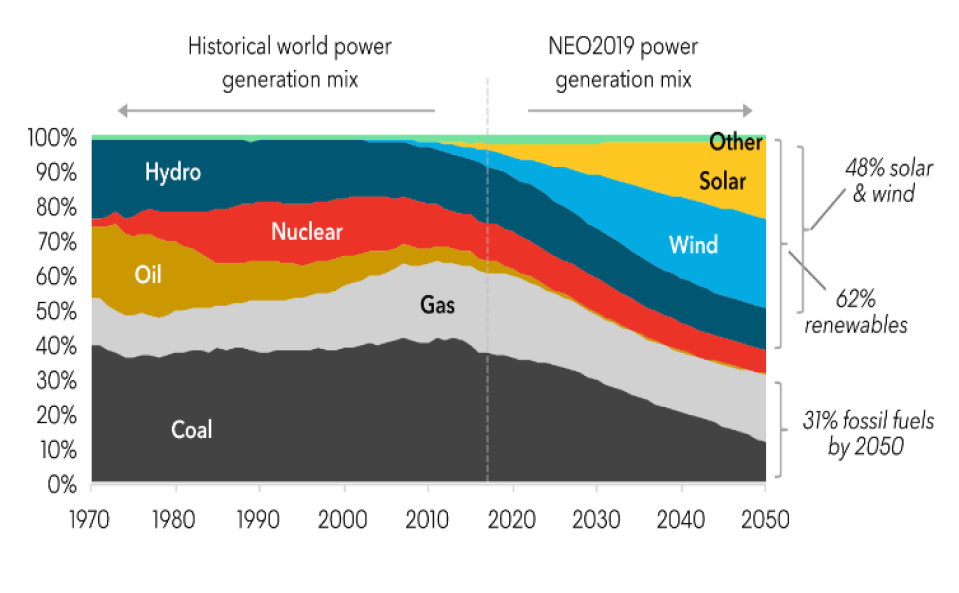

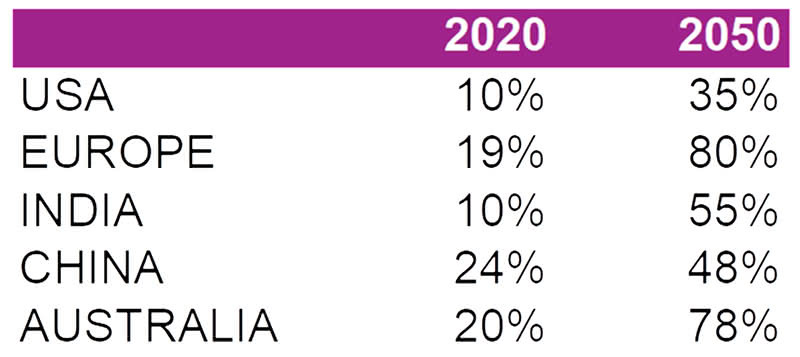

Globally US$45 trillion is expected to be spent on infrastructure projects by 2030. Macquarie is at the forefront of this trend as the No. 1 manager in the space. The huge demand for infrastructure is being driven by rapid urbanisation, particularly in the developing world. With renewable energy, there is a mega trend unfolding as the international community transitions to cleaner energy sources. As chart 2 shows, wind and solar are expected to go from producing 7% of the world’s electricity today to 48% by 2050, growing at a 6.6% annual pace over that time.

Chart 2. The rise of renewable energy

Source: BNEF https://about.bnef.com/new-energy-outlook/

Amazingly, in Australia and Europe, solar and wind penetration in the energy mix is forecast to grow from about 20% today to about 80% in 30 years, and we expect Macquarie will play a key part in this growth.

Table 1. The likely growth of solar and wind power

Source: BNEF

Low interest rates

Unlike most other financials, where low interest rates are a drag on earnings, low interest rates support real-asset values. We know that pension funds are keen to match their liabilities with real assets. We expect continued strong fund flows into Macquarie products and funds.

Covid-19 risks

While we are obviously positive on the medium- and long-term prospects, Macquarie will not emerge scar free from covid-19.

In the near term, we expect that the annuity-style businesses to be hit by the timing in asset realisations due to the pandemic imposing some impediments on the asset sale and due-diligence process. Macquarie also has some exposure to air travel through its leasing business.

In the market-facing businesses, while the initial volatility created from the pandemic will have benefited earnings, we expect global activity to be lower in the year ahead.

However, Macquarie businesses to date have proven more defensive than in previous economic downturns. As countries emerge from the pandemic-induced shutdown and seek to revive their economies, Macquarie is well positioned to benefit from any fiscal spending on infrastructure assets such as roads and rail.

Additionally, Macquarie is sitting on A$25 billion in potential investing firepower, so can take advantage of any opportunities that arise from market dislocations.

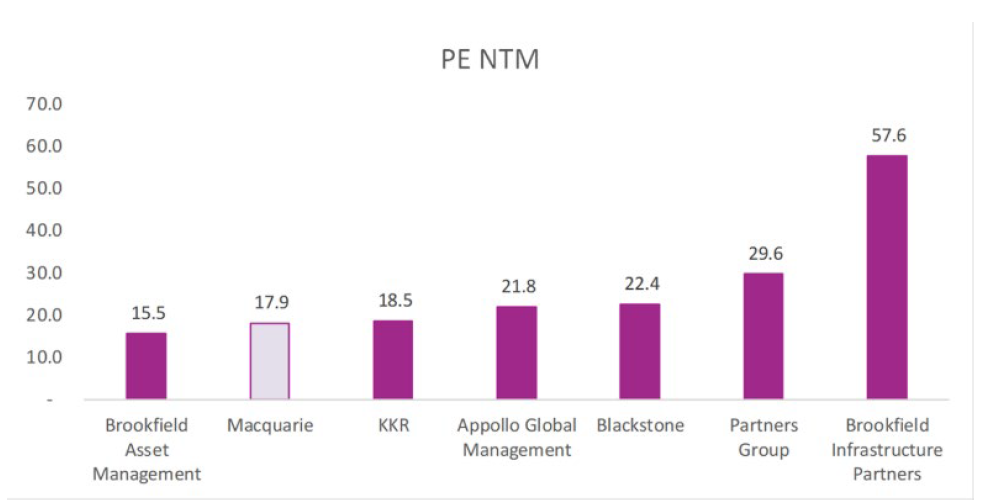

Valuation

Below is a valuation chart that shows that in a relative sense, when comparing Macquarie with other asset-manager peers, its valuation appears reasonable. The median manager is trading on a price-earnings ratio of about 22 times forward earnings versus Macquarie on about 18 times.

Chart 3. Comparing asset managers on valuations

Source: FactSet

This relatively attractive valuation combined with Macquarie’s culture of sensible incentivisation, strong capital allocation skills and well-capitalised balance sheet lead us to expect continued strong earnings growth over the medium term. This will be underpinned by the structural growth story in infrastructure and renewable energy. These factors, combined with our expectation that Macquarie should be able to pay out a dividend of about 4% p.a., lead us to conclude that Macquarie remains a good investment proposition.

By Annabel Riggs and Matt Williams, Airlie Funds Management