QBE is a global commercial insurance provider. The stock is a position we first added to the portfolio in September 2022. This is a company that for a long period had failed to pass almost every step in our process – business quality, financial strength, management quality and valuation. The impetus to revisit the stock was twofold – we liked the medium-term outlook for insurance pricing and the company announced the appointment of a new CEO with a fantastic reputation, Andrew Horton.

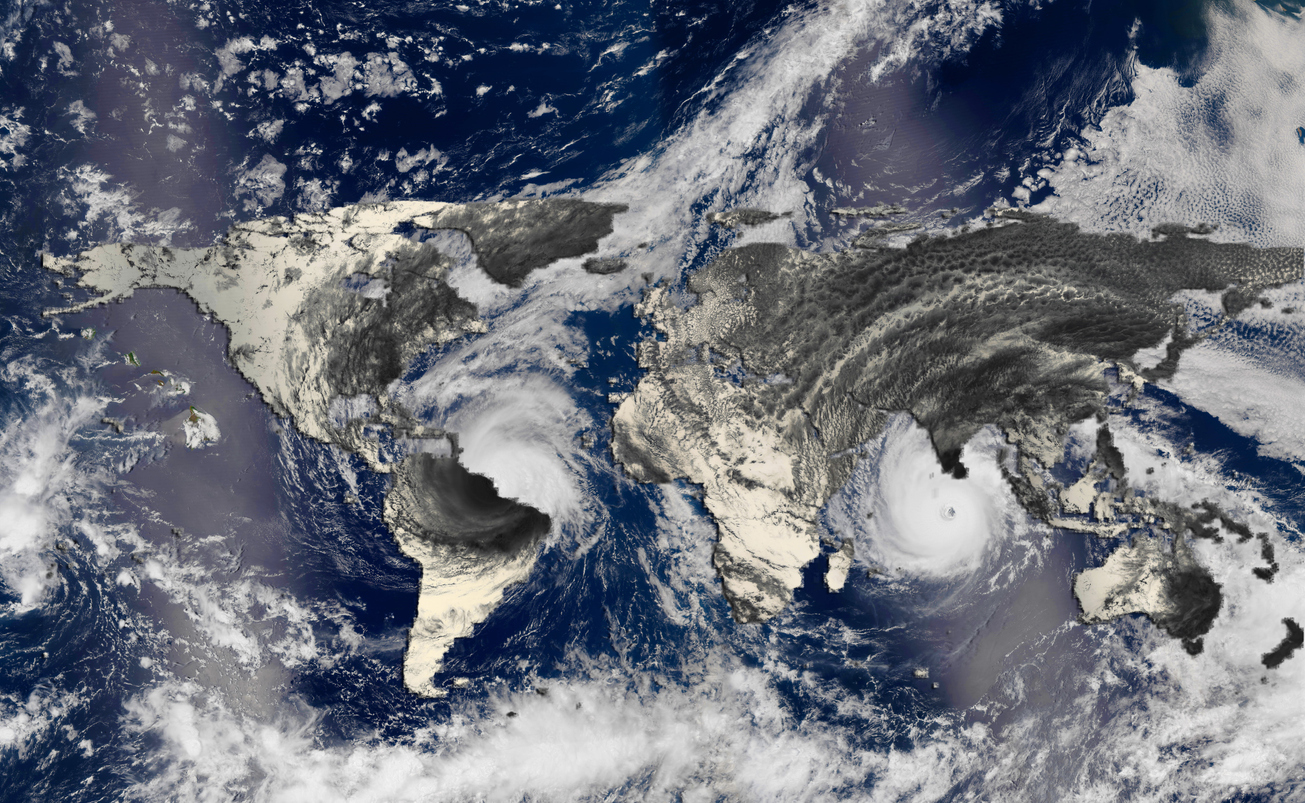

Insurance pricing is cyclical and alternates between periods of soft and hard market conditions. Several years of above-trend catastrophe events (CATs), as well as covid-related business interruption claims and the return of broad-based inflation, has seen the commercial insurance market tighten considerably. The net has been a prolonged period of premium rate growth not seen since the early 2000s. The cycle looks poised to continue (albeit at a lower rate of growth) as insurers digest and push through the impact of reinsurance rate increases, and continue to price for an inflationary environment. (refer to the premium rate change chart over time at the end).

QBE specifically has spent much of the past decade trying to digest an untethered period of acquisition spending that took place under former CEO Frank O’Halloran. Insurance is ultimately a people business and acquiring a range of large and small businesses all over the globe in a short period meant QBE lost track of the quality and exposure of its underwriting. The issues were particularly acute in North America, where the combined operating ratio of the region has remained above 100% for much of the past ten years. However, despite some of the headline results, there have been incremental signs that the underlying quality of QBE’s business has been improving – divestment of underperforming exposures, poaching quality underwriting teams and transactions to de-risk reserves.

QBE’s calendar year 2022 result arguably represented the first reporting period in which investors could plainly see the improved operating performance of the business. Gross written premiums (GWP) grew 13%, inclusive of an average group-wide renewal rate increase of 8%. The company reported GWP growth of 13% constant currency and an underlying combined operating ratio (COR) of 93.7%. Pleasingly, QBE’s North American division reported a COR of 98.9%, the division’s first profitable result since 2018. The result in North America came despite a weaker-than-average year in the crop insurance business and is consistent with management’s focus on portfolio remediation in property programs and growing the retail business to drive scale benefits. At a group level, cost discipline and operating leverage (in a strong rate environment) saw a material improvement in the company’s expense ratio, from 13.3% to 12.4%. CATs came in line with November guidance, albeit ~$100m (10%) higher than the original FY22 allowance. QBE reported a 4.1% running yield for the fixed income portfolio to end the period, which is clearly a material tailwind for FY23 (and will support QBE’s expectations of a mid-teen ROE). QBE’s regulatory capital ratio increased from 1.75x to 1.79x, with debt to total capital reducing from 24.1% to 23.4%, the lowest level in over a decade.

We continue to believe QBE is underearning as margins for both the North American business unit (sub-scale, bad underwriting), and more recently the Lloyd’s syndicates (pandemic business interruption, catastrophes), have dragged on group performance. Industry pricing trends remain favourable, which should drive positive operating leverage, and the recent step-change in investment portfolio yields (as cash rates have lifted rapidly around the world) should see return on equity remain comfortably in the double digits on a three-year view. To date Andrew Horton has demonstrated a sensible approach to growth and risk management, and for all of these reasons QBE still looks attractive to us at ~9.5x P/E.

By Joe Wright, Senior Investment Analyst

Source: company filings

.png)