In the search for high-quality businesses that are undervalued, one of the richest hunting grounds is a ‘jewel in the crown’ scenario, whereby a great business is hidden within a languishing conglomerate. One of Airlie’s core holdings, Tabcorp (TAH.ASX), presents such an opportunity, operating a high-quality Lottery division whose stellar performance has historically been overshadowed by a structurally challenged Wagering division. Fortunately for shareholders, Tabcorp management have made the astute decision to demerge this ‘jewel’ into a new listed vehicle, The Lotteries Corporation. Whilst this process has already served to unlock material value for shareholders, we believe the market continues to undervalue the infrastructure-like qualities of this Lotteries division.

THE LOTTERY CORPORATION (Lotteries & Keno):

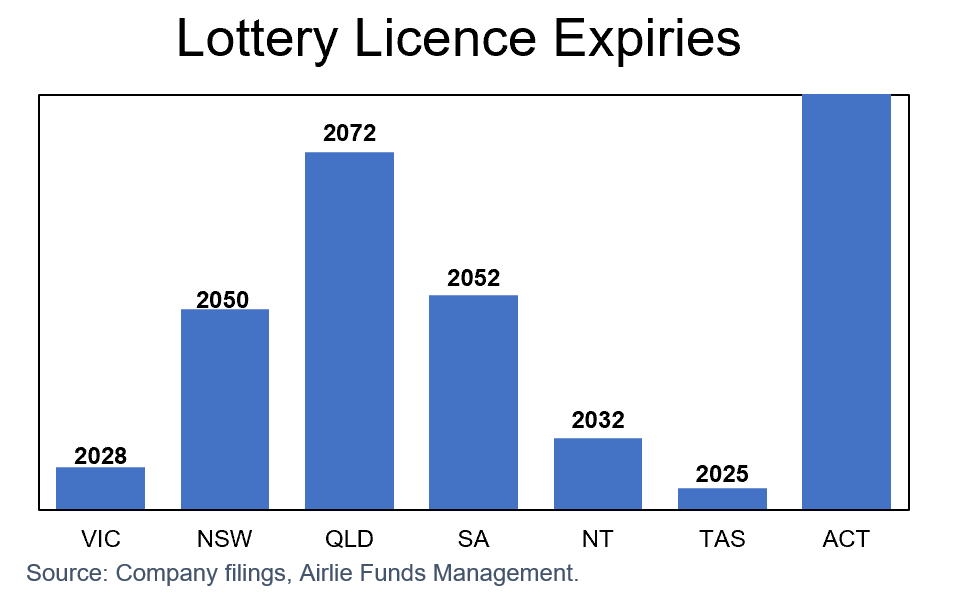

In Australia, Lottery licences are awarded exclusively on a State-wide basis, with Tabcorp currently holding all State licences bar Western Australia (operated by the WA Government). These state-based monopolies exhibit very similar traits to infrastructure concessions; licences are typically long-duration (ranging from 10 to 40yrs in length), demand for the product is insensitive to economic cycles, feature strong pricing power, and offer very dependable and predictable cash flows. However, lottery concessions are far less capital intensive than their typical infrastructure counterparts. In fact, we estimate that Tabcorp’s Lotteries division generates a return on invested capital north of 50%!

The crucial factor for a concession operator is whether future licences can be renewed on attractive terms. For lottery concessions specifically, there are some important aspects that heavily favour the incumbent during the bidding process. The most obvious of these being the benefit of scale; Tabcorp are the only private operator of Lottery licences in Australia. This means that any fixed costs related to technology, systems and processes can be shared across the various State licences, resulting in higher profit margins. Given these economies of scale, Tabcorp can operate any individual licence more profitably than a new entrant and thus the company can bid a higher price for that licence.

Continuity is also an important consideration during the bidding process. The State Government issuing the licence generates material tax revenue based on the value of lottery tickets sold. Any new entrants would need to replicate Tabcorp’s existing retail network, customer lists, infrastructure, systems and processes whilst ensuring no drop in turnover (and tax revenue) for that respective State Government. These State Governments are larger stakeholders in the Lottery operations than even Tabcorp itself; over just the last 3 years, the Lotteries segment has paid over $5.1bn in State taxes, dwarfing Tabcorp’s own estimated profits of <$1bn. It is clearly in the best interest of the various State Governments to maximise the turnover performance of the Lotteries licences rather than attempt to squeeze extra margin by switching operator.

The only material upcoming licence renewal is the Victorian Lottery licence in 2028. Interestingly, whilst Victoria is one of the highest lottery turnover States, it is also one of the lowest margin licences given the State’s higher lottery tax rate. Back in 2012 when Tabcorp acquired the South Australian Lottery licence, they disclosed Victoria’s ‘operator margin’ at 3.9%, compared to 9.2% and 10.5% for NSW and QLD respectively. Importantly, any new entrant seeking to gain material scale in the market would need to wait until 2050 for the opportunity to bid on the NSW licence. Tabcorp has lost a portion of the Victorian licence before, when Intralot were awarded the instant scratchies portion of the licence back in 2007. However, after 6yrs of operation and a reported $63m in losses, Intralot forfeited the licence and it was awarded back to Tabcorp.

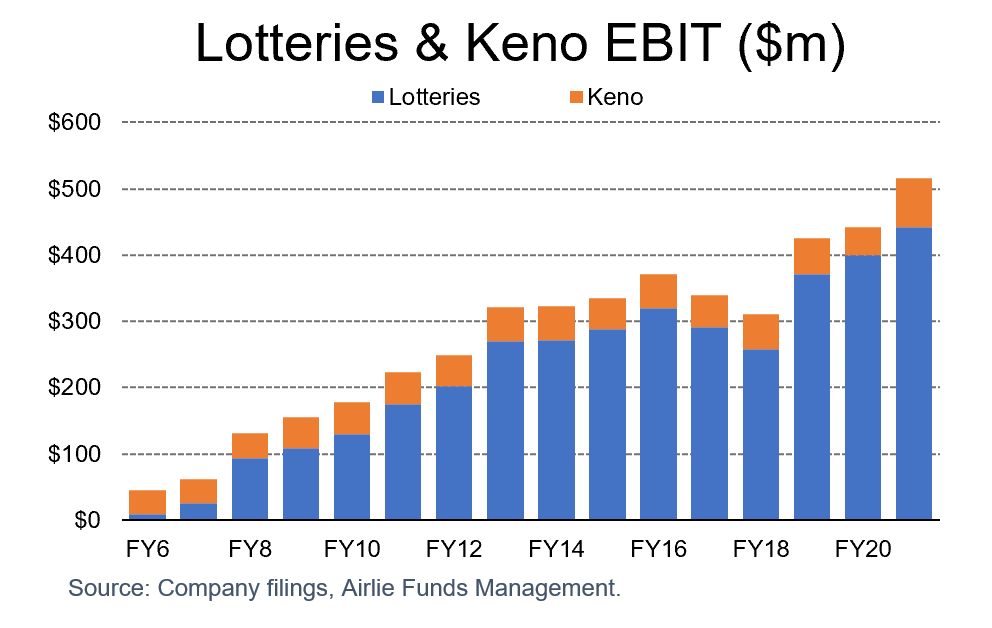

Due to these structural advantages, Tabcorp’s Lotteries & Keno business has one of the most impressive track records of any listed ASX business, growing earnings before interest and tax (EBIT) at a compound annual rate of 9% over the last 10 years.

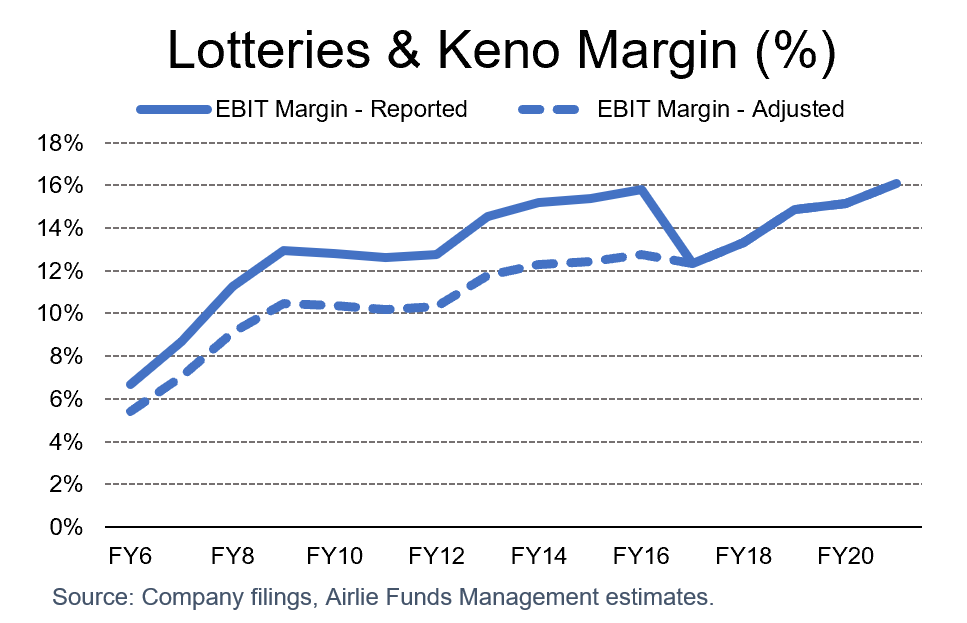

As impressive as this track record appears, the earnings momentum here is actually understated; during the Tabcorp/Tatt’s merger in 2018, $65m in costs were reallocated to the Lottery segment, negatively impacting earnings. As can be seen in the chart below, this change in accounting policy had the effect of materially reducing profit margins in FY17 despite having nothing to do with the fundamental performance of the business.

Margin expansion has driven much of the segment’s historical growth in earnings, but importantly there are several reasons to believe this can continue; (1) continued economies of scale as the company’s fixed costs are spread across a larger revenue base, (2) increasing digital penetration which avoids the ~10.3% commission paid to newsagents, and (3) the superior terms recently negotiated with lottery reseller Jumbo Interactive (JIN.ASX).

THE NEW TABCORP (Wagering, Media and Gaming Services):

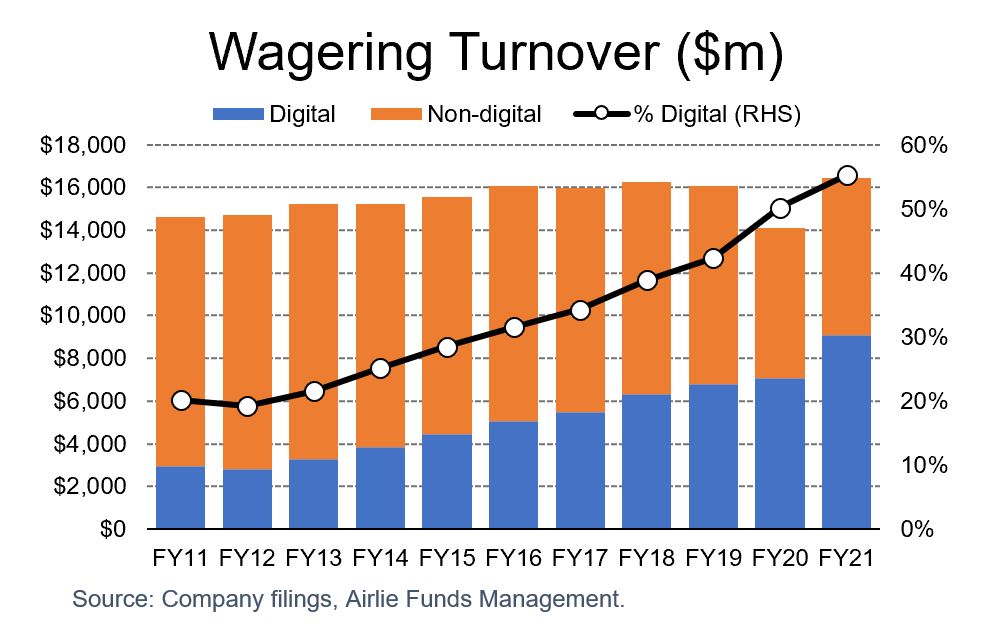

The remaining Tabcorp stub will include the Wagering, Media and Gaming Services businesses. The lion’s share of value here is in the Wagering & Media operations. Under the TAB brand, Tabcorp holds the exclusive licence to conduct wagering operations in retail venues across all Australian States and Territories excluding Western Australia. This retail monopoly is facing structural disruption as punters increasingly elect to bet with online bookmakers such as SportsBet, Ladbrokes and Bet365. Whilst Tabcorp have their own online channels, these digital-first competitors offer superior customer functionality, products and branding, as well as enjoying structural opex and tax advantages. The earnings track record of the Wagering & Media business reflects these difficulties.

But there are glimmers of hope emerging; Tabcorp now generates over $9bn in digital wagering turnover, representing around 55% of total wagering turnover for the group. On a digital-only basis, Tabcorp is the second largest player in the market, with a 21% share of turnover. Furthermore, recent regulatory changes have helped to level the playing field between Tabcorp and its online competitors by reducing structural tax disadvantages.

Clearly other interested parties see value here; Tabcorp has received multiple bids within the last year valuing the Wagering & Media business at $3.5bn ($4bn including the Gaming Services business). Whilst there are significant impediments to completing a transaction (change of ownership provisions and racing body approvals), this does give some indication of the underlying value within the segment not reflected in the current earnings momentum.

VALUATION:

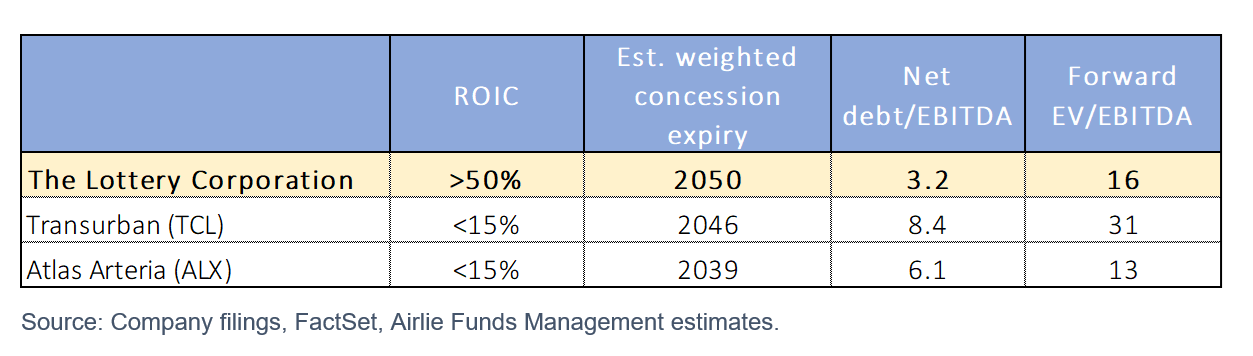

If we ascribe a valuation of $3bn to the Tabcorp stub (a material discount to the recent $4bn bid from Apollo Global Management), we get an implied earnings multiple for The Lottery Corporation of 19x FY22 EBIT. This reflects a 24% premium to the median EV/EBIT of the ASX300 ex-financials and resources. However, on a normalised cash flow basis – adjusted for return on capital employed – The Lottery Corporation is trading about in line with the market despite its superior growth outlook. As can be seen in the table below, the company also compares favourably on a number of metrics to listed toll toad concession operators, Transurban and Atlas Asteria. For this reason, despite the strong share price performance, we continue to see material upside in this core holding.

By Will Granger, Airlie Investment Analyst

.PNG)