Australia’s mini-Berkshire delivers long-term value for shareholders.

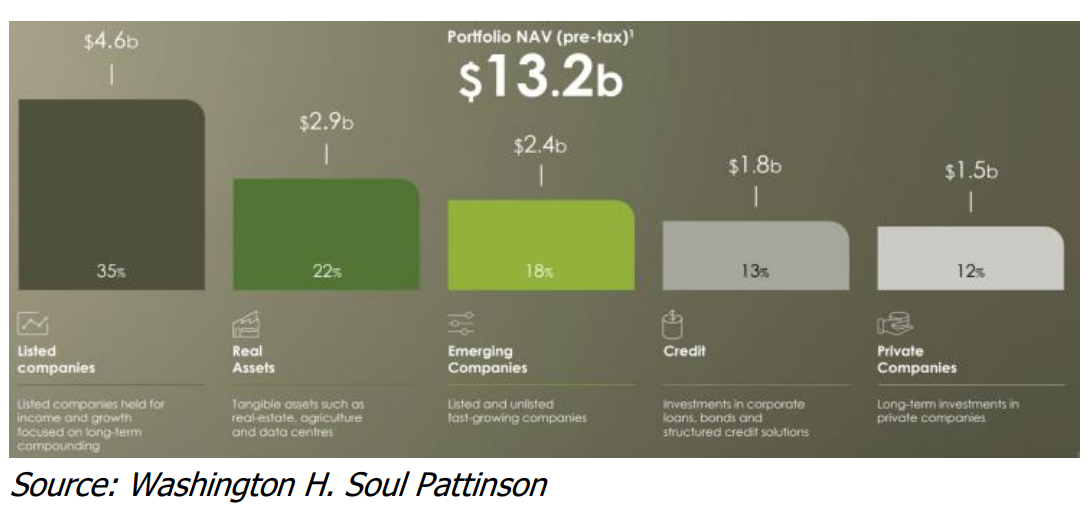

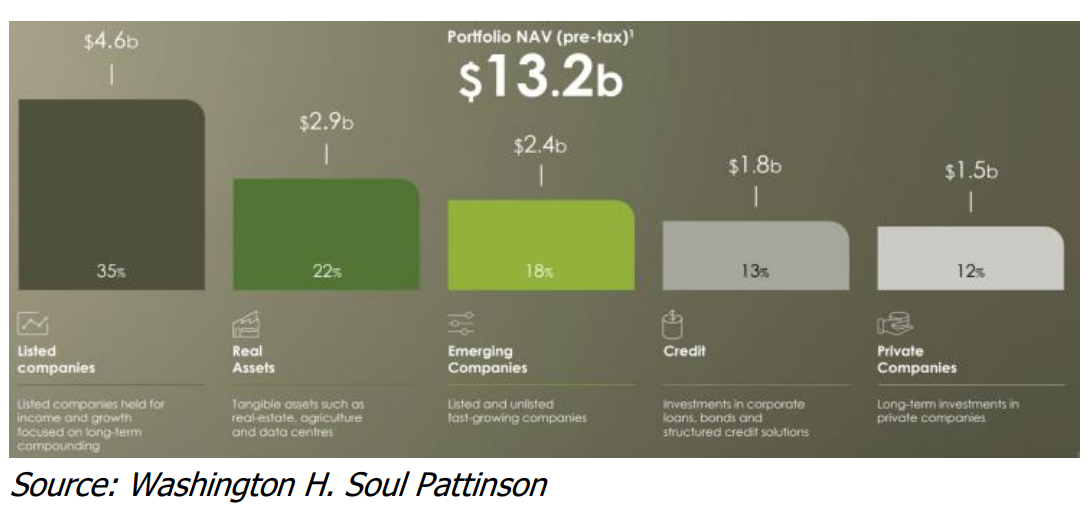

Washington H. Soul Pattinson (SOL) is a diversified investment house that we at Airlie see as Australia’s own mini-Berkshire Hathaway (the famous investment company led by Warren Buffett). SOL invests its permanent capital for the long term across listed large caps and emerging companies, as well as unlisted property, private equity and private credit. Today it oversees a diversified portfolio (NAV of A$13.2 billion)

A long track record of adapting SOL has a long history, founded in 1903 and originally being a sole operator of pharmacy stores. In the 1960s and 1970s, SOL began to diversify by expanding into the building material and resources sectors through positions in Brickworks and other ASX-listed companies. A key step change to the SOL occurred in 2021 through the acquisition of Milton Corporation, which increased the scale of SOL by c. A$3.7 billion in assets held primarily in domestic equities. Today SOL holds A$13.2 billion in net assets.

Investment philosophy

The SOL investment philosophy focuses on identifying long-term superior risk-adjusted returns, with diversification across industry and asset class to allow the portfolio to weather market cycles and generate sustainable returns. As with Berkshire, the beauty of the model is the permanent capital that SOL controls. The company is not like other fund managers with the risk of capital withdrawal ever present, allowing for true long-term investment decisions.

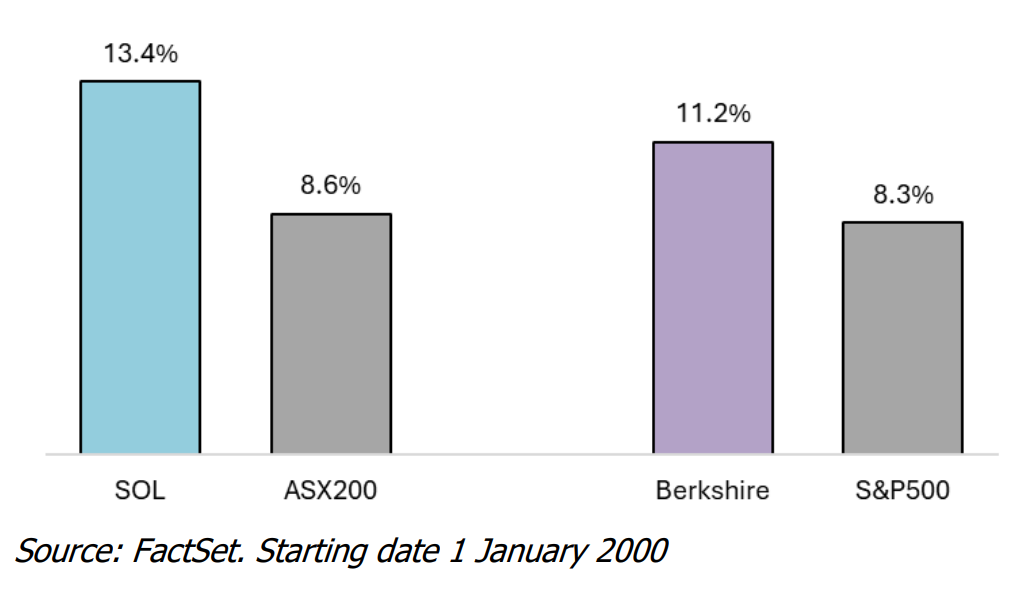

Long-term outperformance

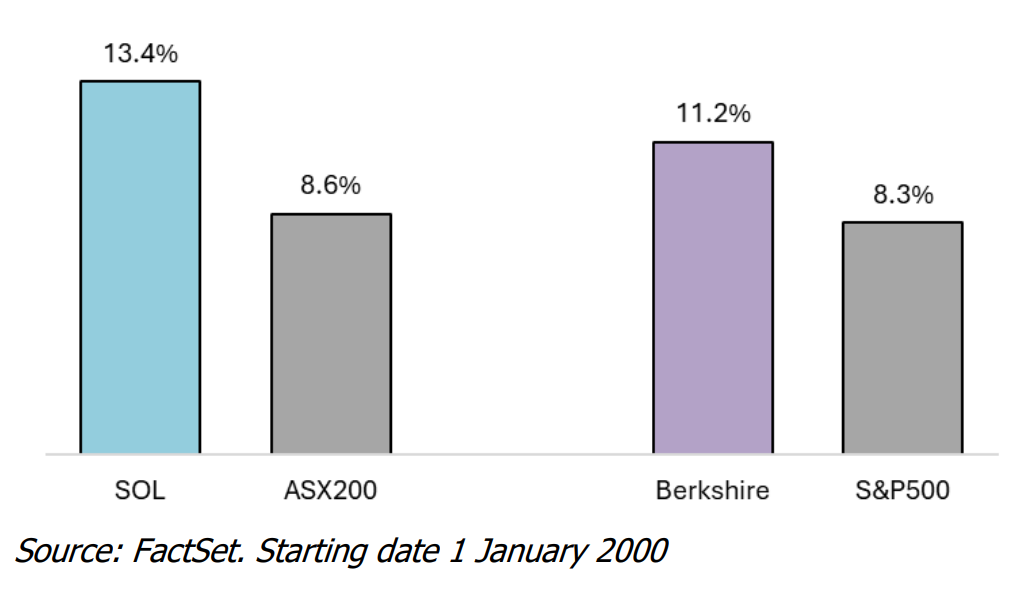

Since 1 January 2000, SOL has delivered a compound total return of 13.4% p.a., compared with 8.6% p.a. for the S&P/ASX 200 over the same period. While we often compare SOL to Berkshire Hathaway, SOL’s returns over this time frame are also ahead of Berkshire’s (11.2% p.a. vs. 8.3% p.a. for the S&P 500).

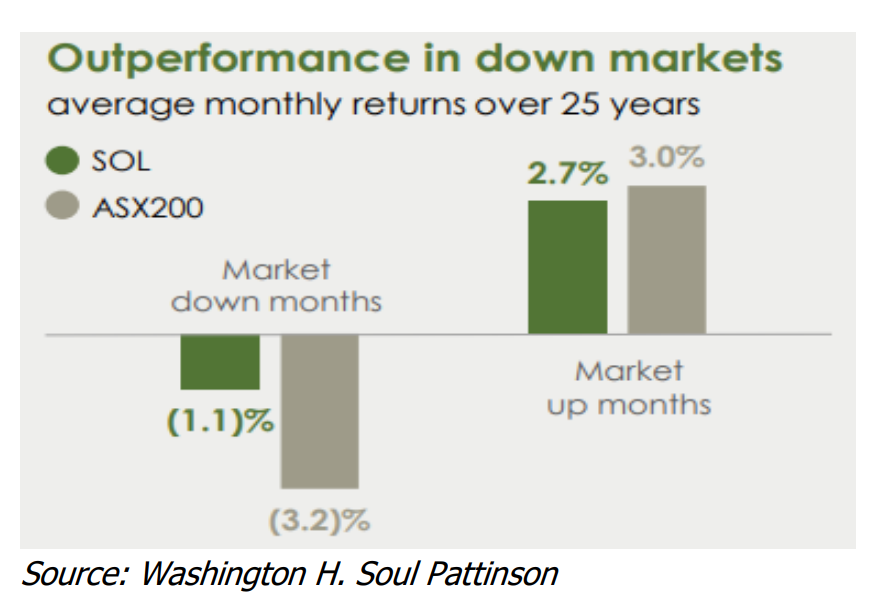

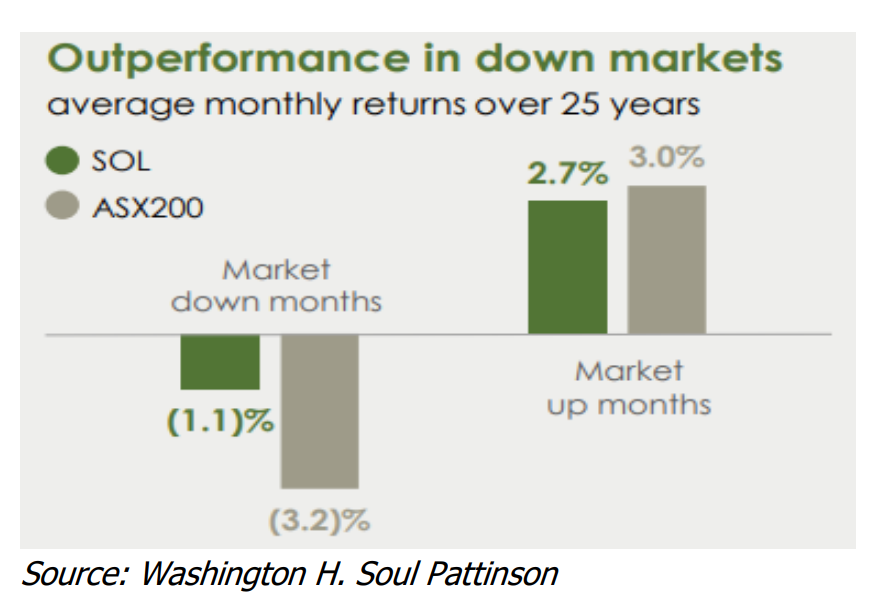

Crucially, this outperformance hasn’t relied on “high beta” exposures that typically do extremely well in bull markets. SOL’s portfolio leans to defensive, cash-generative businesses, which has historically helped it outperform in down markets – a feature we value given today’s relatively high market valuations.

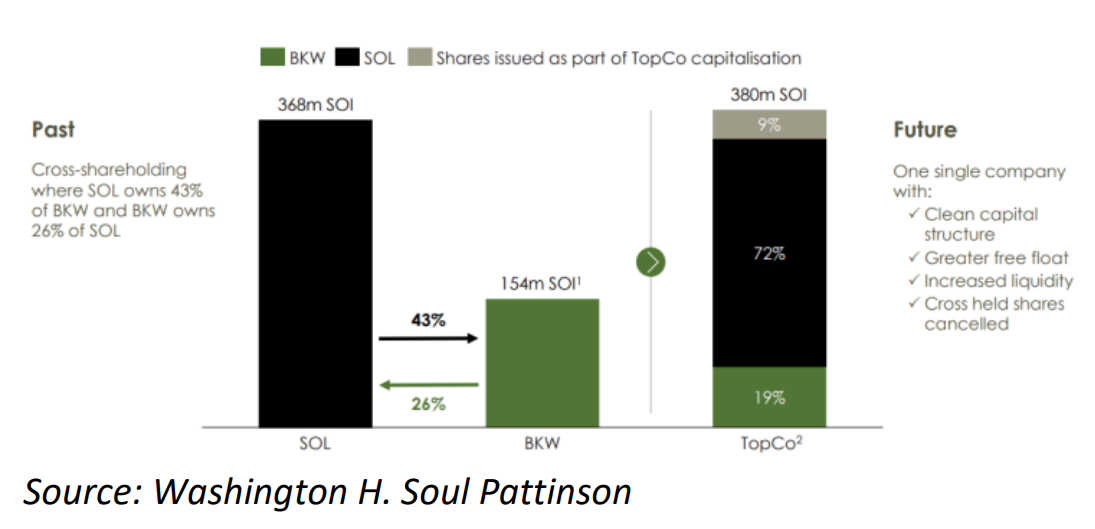

Cleaner structure post Brickworks merger

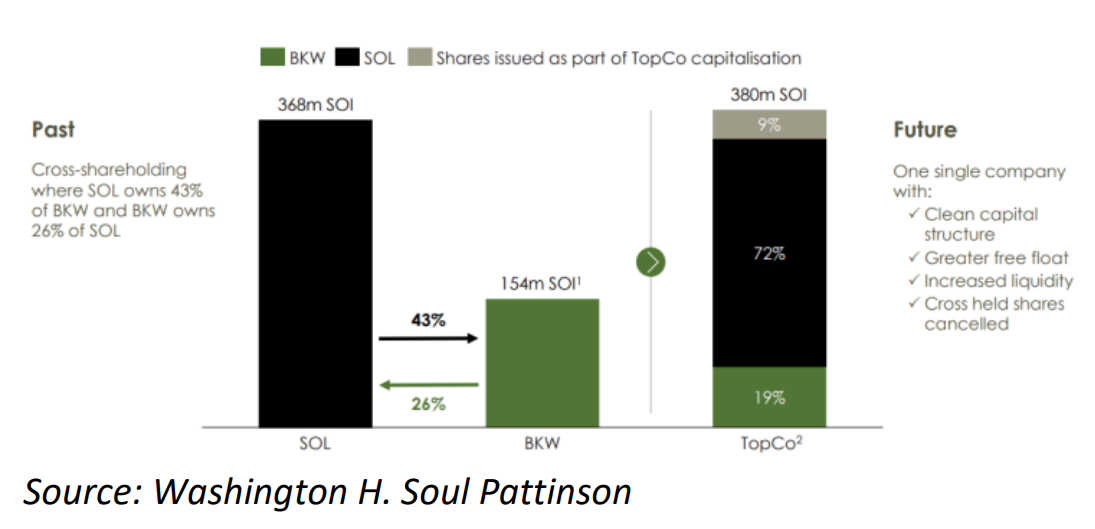

The attractiveness of the SOL investment has only increased by the recent merger with Brickworks. Brickworks and SOL have historically held a long-term cross-shareholding partnership, which saw Brickworks own 26% of SOL and SOL own 43% of Brickworks.

The merger not only cleans up the structure of SOL, but following the capital raise to undertake the merger, it leaves SOL with a net cash balance sheet.

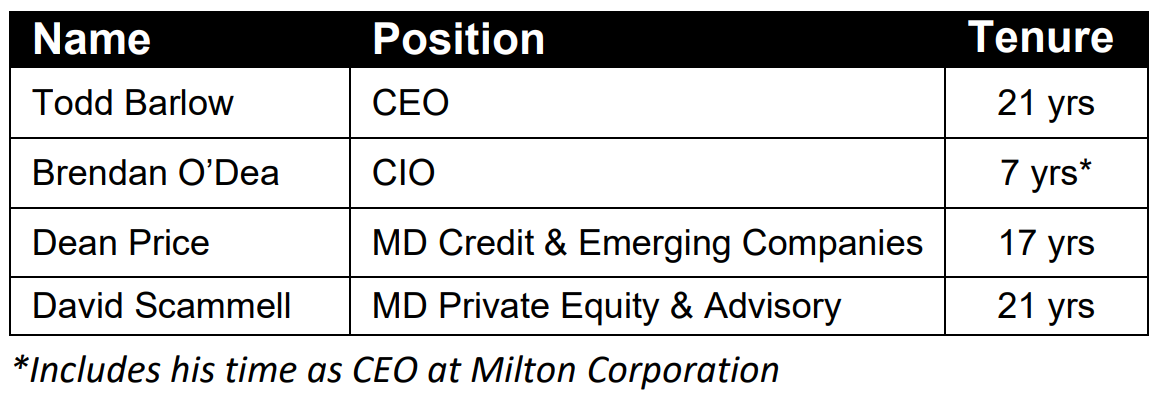

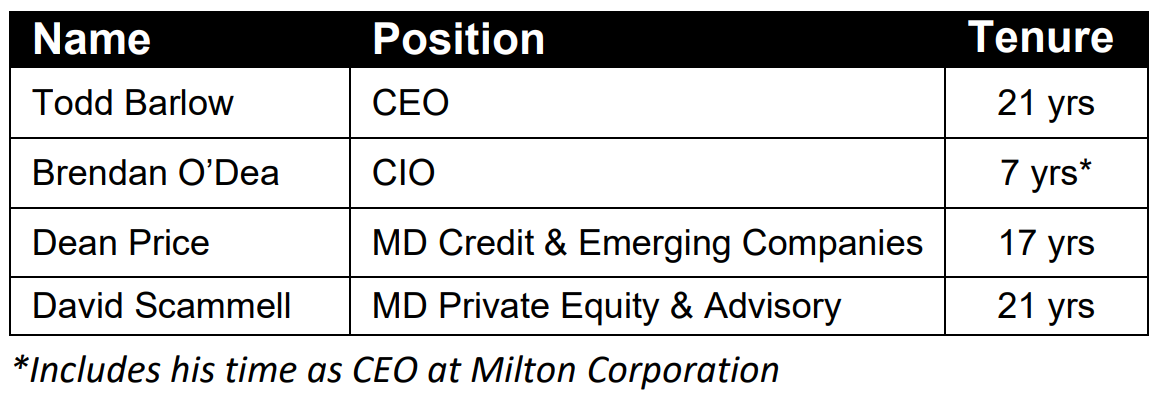

Green light to undertake further investments We maintain a high level of confidence in SOL to continue to undertake high shareholder return investments given the stability and long tenure of key investment personnel including:

With net cash post-merger, SOL has a green light to pursue accretive investments across its opportunity set. In our view, the combination of permanent capital, a proven team, defensive tilt and a simplified structure positions SOL to continue delivering attractive long-term returns for shareholders.

By David Meehan, Investment Analyst

Important Information: Units in the fund(s) referred to herein are issued by Magellan Asset Management Limited (ABN 31 120 593 946, AFS Licence No. 304 301) trading as Airlie Funds Management (‘Airlie’). This material is issued by Airlie and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of an Airlie financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. Airlie makes no guarantee that such information is accurate, complete or timely and does not provide any warranties regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Airlie or the third party responsible for making those statements (as relevant). Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Airlie will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Any third-party trademarks contained herein are the property of their respective owners and Airlie claims no ownership in, nor any affiliation with, such trademarks. Any third-party trademarks that appear in this material are used for information purposes and only to identify the company names or brands of their respective owners. No affiliation, sponsorship or endorsement should be inferred from the use of these trademarks. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Airlie. (080825-#A10)